WVU SMIF Portfolio Update: March 16, 2025

Navigating a difficult and pessimistic market environment.

This is the first installment of what will be a weekly portfolio update report published by the West Virginia University Student Managed Investment Fund. We hope that this report will help alumni, students, investors, and anyone else interested in investing understand what we do in the SMIF program at WVU.

Portfolio Overview

It’s been 5 years since the COVID induced stock market panic of March 2020 and the anniversary did not disappoint. How did we perform and how will we respond to the negative market environment? Let’s get into it.

This week our portfolio ended at $651,940.41 after experiencing a sell-off as uncertainty revolving around U.S. equities continues to rise. Our portfolio decreased by 1.18% while the S&P 500 lost 2.28%. There was a lot of macroeconomic data that came out, which ended up being mostly positive news despite the poor market performance, following last week’s sell-off. Canada placed $29.8 billion in reciprocal tariff measures on the U.S. after President Trump imposed 25% tariffs on steel and aluminum products imported into the U.S. Despite the fact our top 3 marginal winners and losers performed closely, the dollar amount on our bottom 3 outweighed the top 3, furthering the losses for the week.

Top Performers:

Top 3 ($)

1. AR +$966.78

2. GLD +$890.50

3. CRWD +$708.40

Top 3 (%)

1. AR +11.68%

2. BYDDY +10.76%

3. ET +7.27%

Bottom 3 ($)

1. ODFL -$1,466.30

2. WMT -$955.50

3. HOOD -$880.60

Bottom 3 (%)

1. ADBE -12.16%

2. HOOD -11.66%

3. ODFL -9.50%

Market Outlook

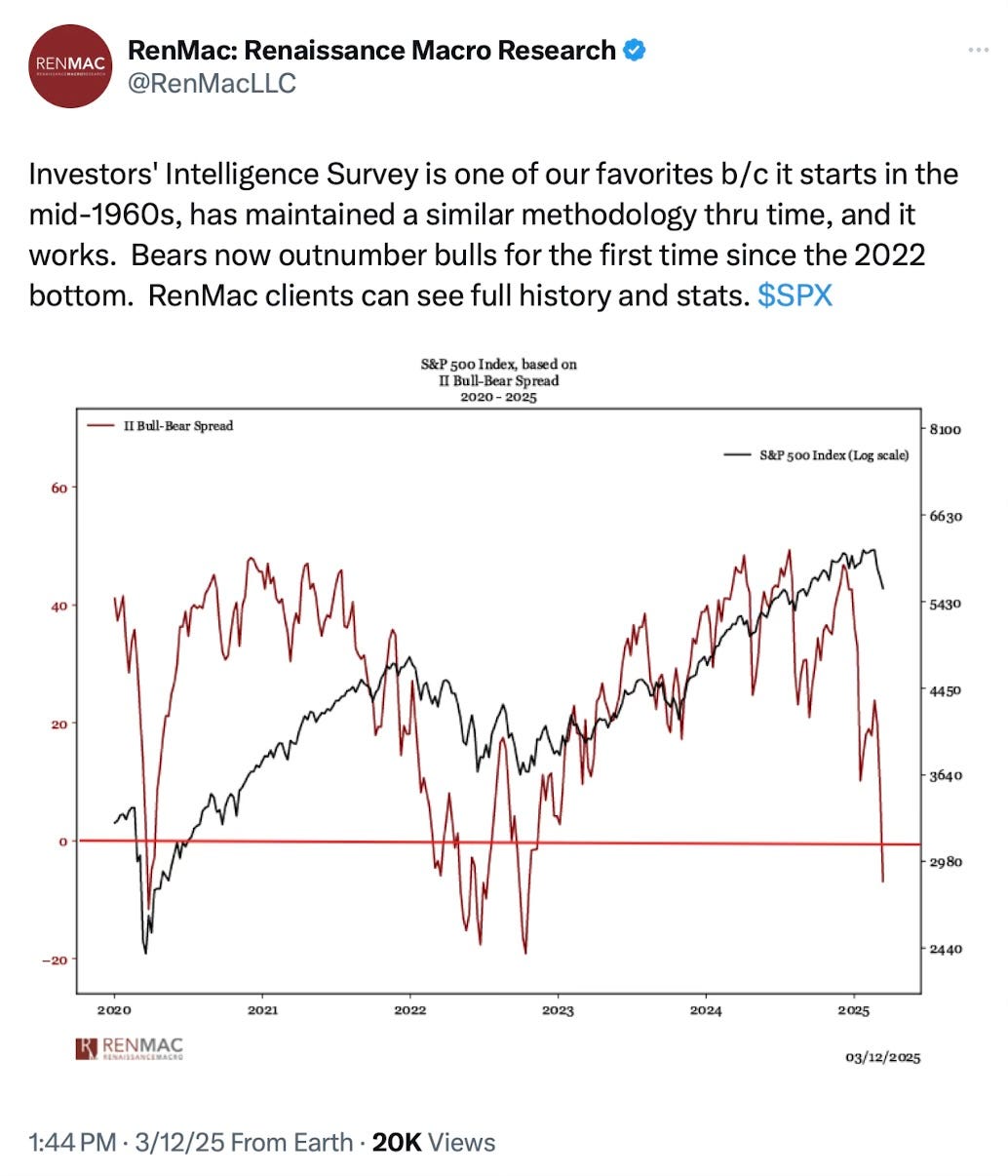

Sentiment continues to decline as investor’s concerns about President Trump’s tariffs and an overall trade war rise. The VIX, or the S&P 500 Volatility Index, indicates whether investors are bullish or bearish, positive gains showing increased volatility and negative gains showing decreased volatility. While the VIX is down on the week, the VIX term structure continued to rise for most of the week, with multiple closes above 1, indicating that sentiment is at extremely high levels and that investors are potentially entering panic mode. As a contrarian, however, a close back below 1 is a buy signal indicating that cooler heads are starting to prevail.

The CPI inflation data came out on Wednesday the 12th at 2.8%, slightly lower than the expected 2.9%. Core CPI data, excluding volatile food and energy prices, came in at 3.1%, which is the lowest level since April 2021. Despite this rather good news, the Dow Jones, S&P 500, and Nasdaq only rose slightly less than 1%, which quickly reversed down almost 1% after President Trump imposed 25% tariffs on Canadian steel and aluminum. Although the data readings came in well, the US economy is still above the Federal Reserve’s target 2% inflation, mainly due to uncertainty revolving around the announced and already imposed tariffs on Canada, Mexico, and China.

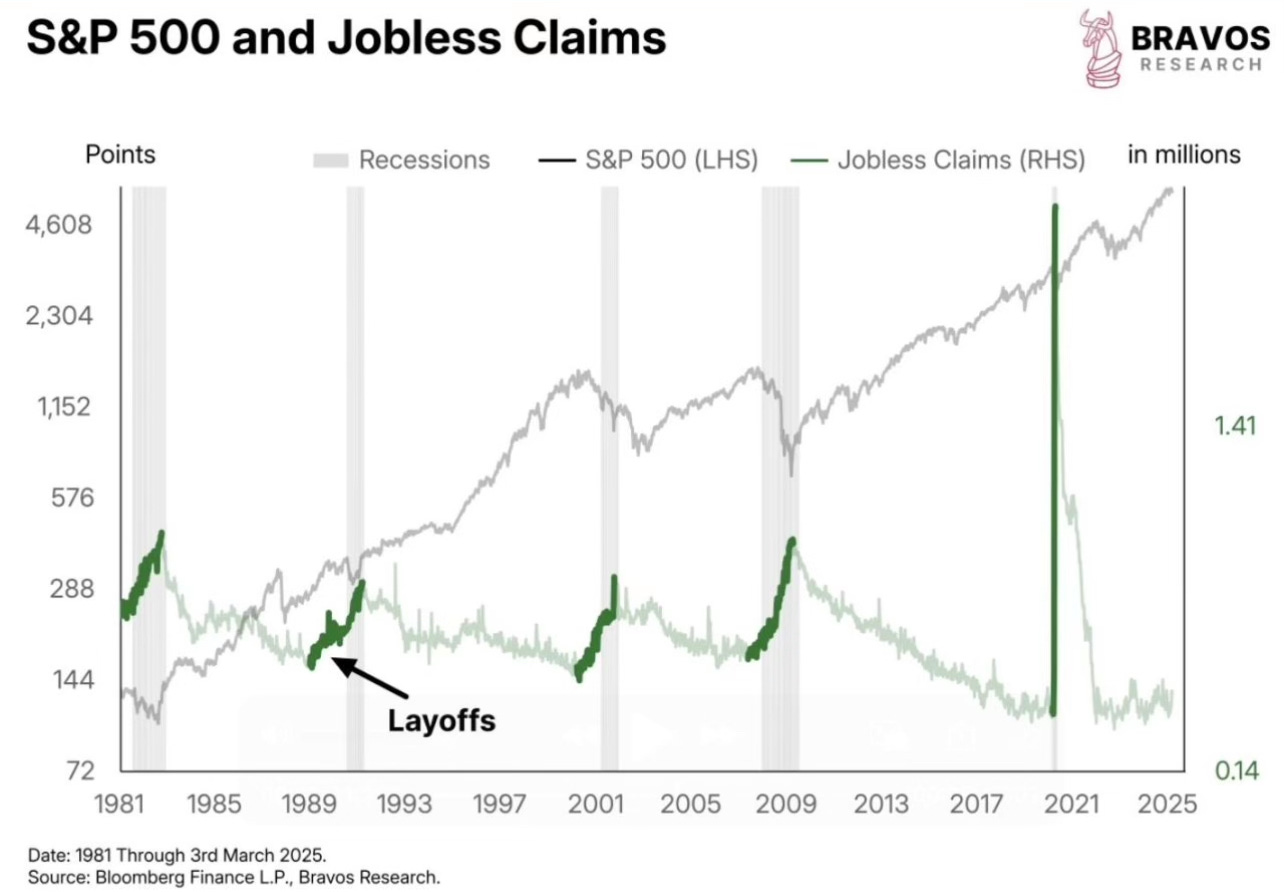

JOLTS Job Openings data also came out for January, reporting 7,740,000 new job openings, or a 4.6% increase, beating expectations of 7,600,000 or 4.5%. Layoffs also came in lower than expected at 1,635,000 rather than the expected 1,806,000. This illustrates that despite uncertainty in the market, job openings are continuing to grow, hinting at positive economic growth in January.

After an almost 15% drop in the price of Bitcoin last week, the cryptocurrency has only regained a mere 5%, coming in at right under $85,000. This is right on par with the continued sell-off in risk-on sectors and an increase in the price of gold, which touched a record $3,000. The U.S. Dollar Index continues to fall, piggybacking off of last week’s decline, indicating there are large capital outflows from the US and into international markets. Net inflows to the largest European ETFs have jumped from the low $10bn to $200bn and counting, while the net inflow to the largest US ETFs have essentially cut in half in the first part of 2025 from around $300bn to just above $150bn.

The German DAX index, equivalent to the Dow Jones in the U.S., is retesting its previous week’s highs. This stems from Germany’s likely new chancellor Friedrich Merz having won support from the Greens party and his plan to hike public borrowing and allow an increase in defense spending. This is the most recent sign of fast moving developments in Europe’s largest economy, which has led to many German defense and financial stocks continuing to rally.

Market Outlook Charts

Consumer Discretionary

During a difficult time for the consumer discretionary sector, the SMIF discretionary holdings have continued to outperform our benchmark, the XLY significantly. Amid the increased volatility and negative sentiment, specifically around uncertain international trade policy and rocky economic outlook, our diversification from the benchmark has allowed us to capture gains in international names, while allocating less to a more exposed US market. Both U.S. valuations and investor sentiment were at bullish extremes going into 2025. Within this volatile backdrop, standout stocks like Alibaba (BABA) and MercadoLibre (MELI) have shown resilience, buoyed by strong growth narratives and a weakening US Dollar, while Match Group (MTCH) and Starbucks (SBUX) face headwinds from shifting consumer spending patterns and a souring economic outlook at home (see chart below of the Atlanta Fed’s Real GDP forecast for Q1 2025). For a week where the XLY was down 4.36%, the SMIF discretionary sector was only down 1.43%. This marks the fourth straight week of declines for our benchmark, where it is officially in a bear market correction of >20%.

While it was another rough week for the discretionary sector as a whole, we still had a few bright spots: BYD Co. (BYDDY) was +10.76% and was the only major gain this week, while Amazon (AMZN), MELI, and BABA were near flat. McDonald’s (MCD) outperformance ended this week, with the name correcting -6.68%. SBUX continued lower, down 7.86%, and MTCH closed lower 5.15%.

Key highlights this week underscore innovation and adaptation among these companies. McDonald’s is revamping its ranks to speed burger breakthroughs, introducing a new R&D role to accelerate product development, a move aimed at staying competitive as consumer preferences evolve. Elsewhere, Tesla’s struggles have opened the door for BYD to take market share in the EV space, with the Chinese automaker’s recent $5.6 billion share sale and free ADAS rollout fueling its momentum. Starbucks’ new CEO, Brian Niccol, is shaking up the coffee chain with plans to simplify menus and boost service speed, addressing recent sales softness. MercadoLibre is doubling down on growth, announcing a $3.4 billion investment in Mexico to expand its e-commerce and fintech footprint. These developments contrast with quieter performances from BABA, which continues to ride AI and cloud tailwinds, and MTCH, which may be feeling the pinch of economic uncertainty. As the sector navigates choppy waters, these strategic shifts highlight a blend of defensive resilience and aggressive expansion.

While there were no trades this week, we continue to look to buy undervalued names with favorable technicals and sentiment. We are looking to add to SBUX once it finds support, and continue to watch our Chinese holdings during a volatile time. We will continue to manage our risk, ensuring ample diversification, and look to deploy cash during this significant market correction.

Benchmark: XLP: -4.04%

Biggest Winner (%) : BYDDY +10.76%

Biggest Winner ($) : BYDDY +$388.80

Biggest Loser (%) : SBUX -7.86%

Biggest Loser ($) : AMZN -$1,275.37

Consumer Staples

This week’s report highlights key movements and developments within the consumer staples sector, emphasizing its resilience amid inflationary pressures, evolving consumer trends, and ongoing digital transformation.

Within our portfolio, Sherwin-Williams (SHW) has seen fluctuating institutional activity, with some investors adjusting their positions, reflecting mixed sentiment on its near-term trajectory. While the company remains well-positioned in the specialty chemicals space, recent earnings results underscore the importance of monitoring cost pressures and profitability trends.

PriceSmart (PSMT) continues to show strength in key retail segments, with solid revenue growth and operational efficiencies contributing to its long-term stability. However, recent stock performance suggests some market caution. With the new CEO, tariffs and currency issues, it is making us reconsider our initial investment thesis. We are watching the price movements closely.

Philip Morris (PM) remains a favored holding within the fast-moving consumer goods sector, particularly as it expands its portfolio of reduced-risk products. Its ability to sustain demand, even in challenging economic environments, keeps it among top picks for investors focused on stability and innovation.

For other holdings, Coca-Cola (KO), Walmart (WMT), and Post Holdings (POST), there were no major updates this week. However, these companies continue to provide defensive strength within the portfolio. Walmart, in particular, remains well-positioned due to its adaptability in managing inflationary trends and expanding digital initiatives.

Overall, the sector continues to offer stability, but selective scrutiny of individual holdings is crucial for navigating market fluctuations and identifying emerging opportunities.

Benchmark: XLP: -4.04%

Biggest Winner (%) : PM +0.62%

Biggest Winner ($) : PM +$53.01

Biggest Loser (%) : WMT -6.95%

Biggest Loser ($) : WMT -$955.50

Energy, Materials, and Utilities

SMIF EMU recently acquired Gold Fields Limited (GFI) this week, an international gold miner, following a significant technical breakout. GFI recently surpassed a long-term resistance level dating back to 1980, signaling strong bullish momentum and potential for further upside. We believe this move is well-supported by fundamentals, as gold miners have lagged behind the price of gold for months, despite gold itself continuing to hit all-time highs. This disconnect presents an attractive opportunity, and GFI’s operational strength and global footprint make it a compelling addition to our holdings as we anticipate a catch-up in miner valuations. This move also reflects the positioning of the SMIF portfolio as a whole, which has recently shifted capital out of domestic markets into relatively undervalued international markets. GFI operates out of South Africa and has mines in Australia, Canada, and Chile.

Recent news on oil prices and tariffs introduces a mixed outlook for our energy holdings, including Energy Transfer (ET), Antero Resources (AR), and Exxon Mobil (XOM). Oil prices have faced downward pressure in early 2025, with Brent crude dipping below $65 per barrel. This is primarily due to increased production expectations related to reduced restrictions on domestic oil production. Furthermore, tariffs imposed by the Trump administration, could disrupt supply chains and decrease international demand, potentially weighing on ET’s midstream operations and XOM’s refining margins, which already saw a 67% profit plunge in 2024 earnings reported on January 31. Conversely, AR’s focus on natural gas and cost efficiency may provide some insulation, though broader energy market volatility remains a risk we’re monitoring closely.

Meanwhile, our utilities holdings, Spire Inc. (SR) and American Water Works (AWK), remain stable anchors, providing reliable gains amidst the recent economic uncertainty and downturn in the market as a whole. Linde plc’s (LIN) industrial exposure could benefit from any economic uptick tied to tariff-driven manufacturing shifts. Overall, our diversified approach across energy, materials, and utilities positions us to navigate these dynamic market conditions effectively.

Benchmark: XLU: 2.04%, XLE: 2.66%, XLB: -2.10%

Biggest Winner (%) : AR +10.94%

Biggest Winner ($) : GLD +$884.00

Biggest Loser (%) : LIN -2.63%

Biggest Loser ($) : LIN -$181.50

Financials

This week the financial sector declined at a slower pace than it has been over the past month. The SMIF Financial Sector fell 2.91% compared to the benchmark which fell 1.22%. The VIX term structure has normalized which is a positive sign for risk assets (see chart below this paragraph). The SMIF Financial Sector has been holding a large amount of cash as we have endured this correction and looked for opportunities internationally. We intend to take advantage of the potential bottom that formed Friday this week by deploying our cash into the international ideas that we have been looking at through this correction.

Last week we bought our first two international banks, Danske Bank (DNKEY) and BanColombia (CIB), in order to capitalize on flows out of the United States and into foreign markets (see chart below from Bloomberg’s Simon White). European financials continue to be an attractive target however, we are also looking into investment banks and fintech in Latin America, as well as real estate lending and fintech in China.

Latin America saw an increase of roughly 10% in their M&A deal making transactions. Leading the charge is Brazil with over $3.3B in M&A transactions during the period. The stocks at the top of our Brazilian watchlist include Itau Unibanco (ITUB), Banco Bradesco (BBDO), and Banco Santander Brasil (BSBR).

The Chinese government has done a lot of work to stimulate individual investment from its citizens, such as the implementation of IRAs and stimulative economic policy making. The Chinese real estate market has also begun to recover from one of its largest crashes in the past century. At the top of our Chinese watchlist are FinVolution Group (FINV) and KE Holdings (BEKE). FINV is a personal consumer finance company that is well positioned to benefit from increased individual investments from Chinese citizens. BEKE is a real estate lending company that will benefit from the uptick in residential real estate purchases.

Benchmark: XLF: -1.22%

Biggest Winner ($) - CIB +$266.40

Biggest Winner (%) - CIB +3.55%

Biggest Loser ($) - HOOD -$880.60

Biggest Loser (%) - HOOD -11.66%

Healthcare

Eli Lilly (LLY) continued to fall this week before a slight Friday recovery, on news of competition in the GLP-1 space. Amgen continued to rally on Monday off its prior-week announcement of Maritide phase three trials, before falling sharply and remaining down the rest of the week. The news that these stocks and Novo Nordisk are reacting to is a $5.3 Billion deal between Roche (RHHBY) and Zealand Pharma (ZLDPF) to co-produce a weight loss drug aimed at optimizing the amount of muscle mass retained while still encouraging weight loss. The two companies believe that this drug, a combination of Roche’s CT-388 and Zealand’s Amylin, will create a distinct competitive advantage over other GLP-1 products.

Merck & Company (MRK) shares showed intra-week volatility, but ultimately closed slightly down on the week. The stock found significant resistance at its 200 week EMA and previous uptrend channel. A federal judge ruled that MRK’s Gardasil had no correlation with alleged safety risks- alleviating the company from over 200 lawsuits. On Tuesday 3/10, the company opened a $1 Billion vaccine manufacturing facility in Durham, NC. We remain positive on the long-term outlook for MRK.

We disposed of our 42 share position in Edwards Life Sciences (EW) after signs of technical weakness and limited upside. We hope to put the proceeds of the sale to work soon as we evaluate potential new positions. We held off from adding to Johnson & Johnson (JNJ), seeing that the company failed to sustain a technical chart pattern breakout and fell back into its previous trend channel.

Despite the news of competition and drop in stock price, LLY remains poised to grow with the current superiority in efficacy of its GLP-1 products over NVO’s Wegovy and Ozempic. Additionally, LLY reported that they plan to launch Mounjaro in India, Brazil, and Mexico in late 2025. A large-scale launch in China is also likely this year. Analysis of TAM in these countries based on population, obesity rates, socioeconomic factors, and LLY’s market share show that LLY could conservatively gain between 8 million and 17 million new GLP-1 customers by expanding to these markets. LLY is also developing a GLP-1 pill, which would greatly improve market share and gross margins for the company if successful.

Benchmark: XLV: -2.91%

Biggest Winner (%) : N/A

Biggest Winner ($) : N/A

Biggest Loser (%) : LLY -6.45%

Biggest Loser ($) : AMGN -$613.25

Industrials

This week, the SMIF Industrial sector demonstrated resilience to broader market declines. The sector experienced a (1.58%) decline, compared the XLI’s (2.32%) and the SPX’s (2.48%) decline.

The looming threat of tariffs and trade wars, mixed economic data, and fears of slower growth have been rapidly pricing into the market over the last few weeks. Our positions with larger exposure to imports faced significant declines. Most notably, Stanley Black and Decker (SWK) fell nearly 9% and John Deere (DE) fell around 4.50% on the week. Additionally, Old Dominion Freight Line experienced over a 9% decline, reflecting fears of a potential slowdown in the domestic economy and further expected hardship in the LTL industry.

Our international holding in Embraer (ERJ) rallied another 3.70% on the week, further suggesting a rotation of capital outside the US. The Brazilian Aircraft manufacturer continues to win contracts, as demand for their specialized aircraft products grows. We plan on continuing to look for opportunities outside the US as international stocks still outperform US stocks in the first quarter of 2025.

Looking forward, we plan to monitor opportunities to add to our positions in ERJ, Lockheed Martin (LMT), and DE. Despite federal budget cuts and plans to cut defense spending, we remain optimistic on the outlook of LMT. Our entire investment philosophy is centered around finding value when there is uncertainty and fear. Overall, we see any drop in LMT as an opportunity to buy. European countries are expected to bolster defense spending and countries such as India plan to upgrade defense, factors that should benefit LMT regardless of fear about US military budget cuts and tensions between the US and other countries.

Next week, we will watch economic data releases such as Industrial production MoM, Housing starts and existing home sales, and retail sales advance MoM to further gauge the health of the Industrials sector.

Benchmark: XLI: -2.32%

Biggest Winner ($) - ERJ +$206.98

Biggest Winner (%) - MMM +2.81%

Biggest Loser ($) - ODFL -$1,466.30

Biggest Loser (%) - ODFL -9.50%

Technology

This week, the tech landscape painted a picture of both resilience and challenge across our holdings. Microsoft (MSFT) reinforced its market position by announcing a new cloud partnership and deepening its investments in artificial intelligence, a move that injected renewed confidence amid broader market uncertainty. At the same time, Taiwan Semiconductor (TSM) continued to perform steadily, buoyed by reports of ramped-up chip production to meet escalating global demand, while AMD experienced modest declines as analysts delivered mixed reviews of its latest product lineup.

Our strategic play in Chinese tech via KWEB proved its merit rising slightly as our benchmark declined over 2% on the week—a testament to favorable government policies and ongoing innovation in the AI space. Early in the week, CrowdStrike (CRWD) suffered a steep decline, down nearly 9% at one point, reflecting the intensified competition in cybersecurity and mounting market headwinds. CRWD rebounded to end the week up over 6%. Our worst performer this week was Adobe (ADBE), declining over 12% after posting EPS and revenue beats with forward guidance that did not satisfy Wall Street’s high expectations. Other positions, including Amphenol (APH), Toast (TOST), and Google (GOOGL), remained relatively stable, underscoring the benefits of our diversified approach in navigating turbulent times.

Looking ahead, we are actively evaluating potential additions to our tech positions to bolster our portfolio and capture emerging opportunities in this dynamic sector.

Benchmark: XLK: -2.10%

Biggest Winner (%) : CRWD +6.07%

Biggest Winner ($) : CRWD +$708.40

Biggest Loser (%) : ADBE -12.16%

Biggest Loser ($) : ADBE -$655.92

Risks and Opportunities

Risks:

There are several key risks that the stock market is facing in the current market environment. First, if analysts react to the momentum that has unfolded over the past few weeks, and bake-in lower earnings due to Trump’s tariffs, then bearish sentiment could set in causing a prolonged sell-off. Additionally, widening credit spreads in U.S. investment-grade bonds signal concerns over future domestic economic activity, suggesting that investors are bracing for slower growth or even a potential slowdown. While positive economic data like CPI and job openings have been reported, stock indices have shown only modest gains, quickly reversing downward, signaling that market sentiment may not fully reflect the improving economic outlook. Cryptocurrency volatility and the declining U.S. Dollar Index further underscore broader market uncertainty, suggesting potential risks for domestic economic conditions.Friday's market bounce provided a brief respite, there is a risk that volatility could ramp up again on Monday. If the VIX term structure inverts once more, it could signal a deeper correction, potentially leading to lower lows in the near term.

Opportunities:

Although markets have not reacted to the positive economic data, this could still be an early sign that equities are at a discount right now. The recent correction appears to be more driven by market flows than underlying company fundamentals, which is evidenced by the lack of correlation between equities and commodities during this sell-off. This disconnect could provide an opportunity to acquire U.S. companies at attractive valuations, particularly if the fundamental outlook remains solid. Consumer spending continues to show strength, a crucial indicator that often signals continued corporate profitability. This resilience in spending is a strong tailwind for key sectors in our portfolio, including financials, discretionary, staples, and tech, suggesting that fundamentals in these areas remain robust despite broader market concerns.

Conclusion

This week, our portfolio ended at $651,940.41, down 1.18%. While positive economic data, including better-than-expected CPI and job openings, suggests continued growth, market sentiment remains bearish with widening credit spreads, declining U.S. Dollar Index, and uncertainty surrounding tariffs. However, the correction seems driven more by market flows than fundamentals, presenting opportunities to acquire U.S. companies at attractive valuations. Additionally, strong international market inflows, particularly in Europe, offer diversification opportunities, positioning the portfolio to capitalize on growth in stronger global economies. As we move forward, we will continue to identify and capitalize on the opportunities that arise from the current market conditions.

Next week is West Virginia University’s Spring Break and there will be no weekly portfolio report. However, we will resume content production the week of the 3/24-3/28. That week we will also be introducing the “Weekly Chart Pack” in which we will publish a chart deck of the most interesting charts, graphs, and tables we encountered during the week.

Stay tuned!

- SMIF

Disclaimer: None of the views or opinions expressed here is indicative of those held by West Virginia University. The content provided by the WVU Student Managed Investment Fund newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.