WVU SMIF Portfolio Update: April 27, 2025

Earnings Season and Easing Tariff Fears Lift Market Sentiment

Portfolio Overview

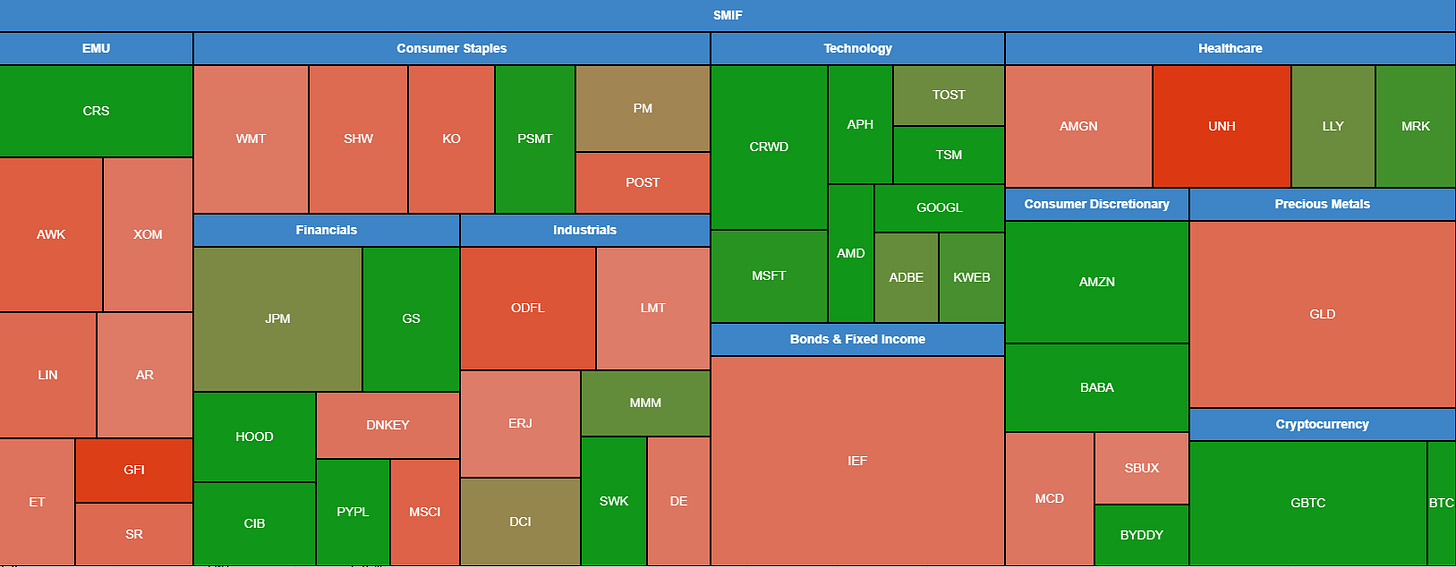

The portfolio was up 2.42% this week as sentiment began to recover in markets. We underperformed the S&P 500 Index, which was up 4.59%, due to differences in our risk profile against the index. (See last week, where SMIF fell less than the overall market). We are working to deploy capital at this point, with several buy orders set to go through on Monday.

Top & Bottom Performers:

Top 3 (%):

HOOD +20.08%

CRS +17.05%

APH +16.58%

Bottom 3 (%):

GFI -9.13%

UNH -7.81%

ODFL -4.56%

Market Outlook

This week saw signs of recovery in markets as Trump eased his stances on China, tariffs, and Jerome Powell. The notion of Trump firing Jerome Powell for not lowering interest rates was spelling rising uncertainty in US treasuries and equity markets. On Tuesday, Trump announced that he does not intend to fire the current Fed chair, which came as a sigh of relief for owners of US assets. Furthermore, Trump remarked that both the US and China are going to be “very nice” as they work to reduce tariffs on each side which he said will “come down substantially.” According to White House press secretary, Karoline Leavitt, over 100 countries have reached out to the US for trade negotiations thus far. While trade relationships may take time to recover, this is a promising step for markets.

The CNN Fear and Greed Index rose from “Extreme Fear” to “Fear” this week, largely driven by buyers of junk bonds who may feel more favorable about companies’ cash flows than ratings agencies are suggesting.

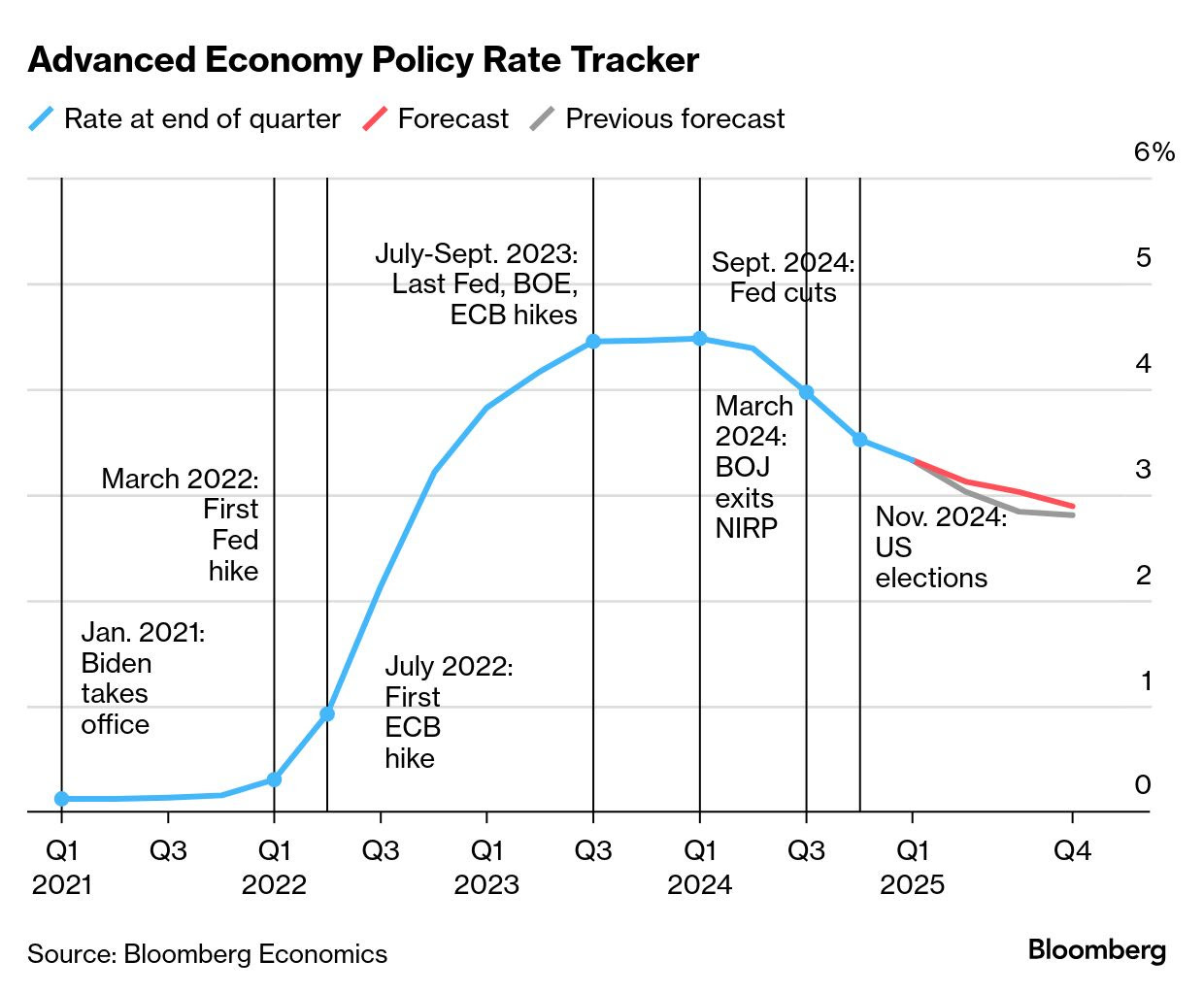

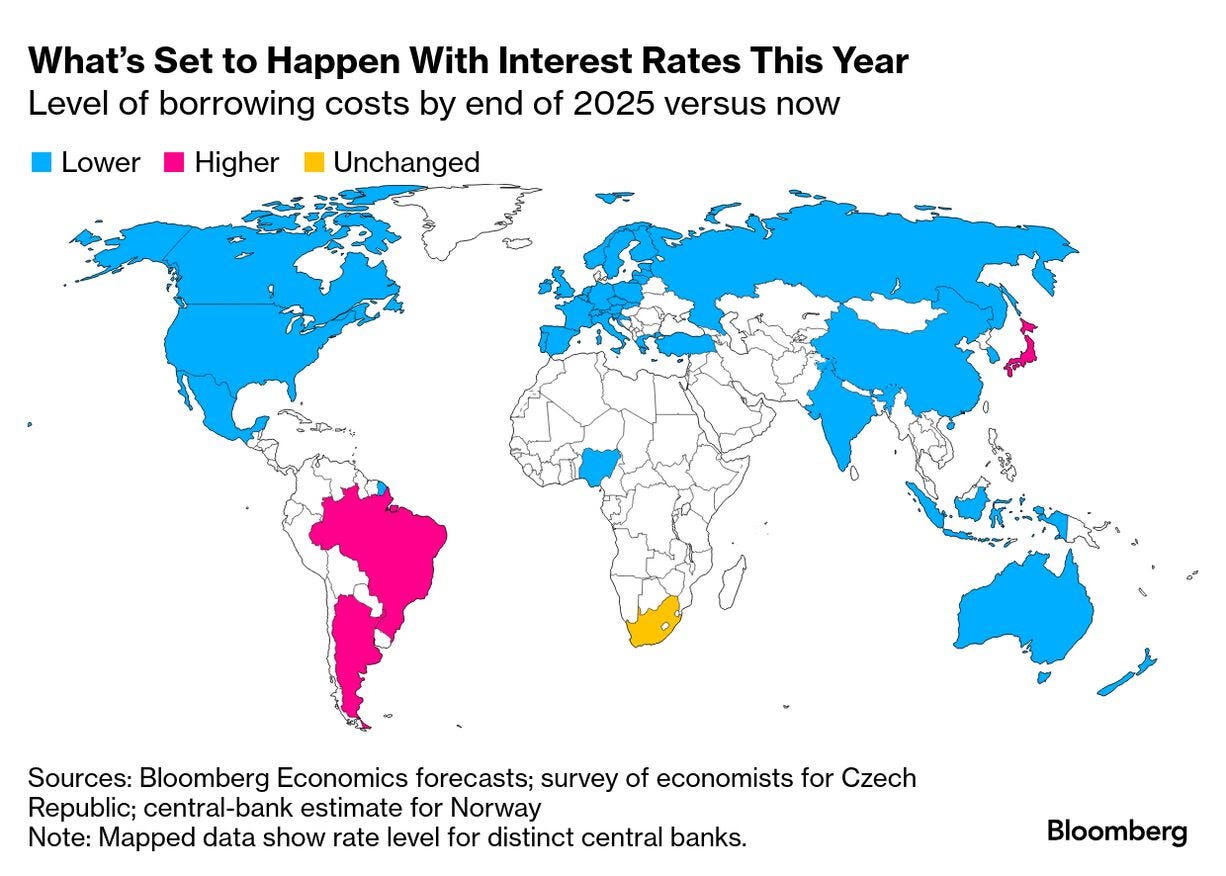

Despite Powell’s newfound job security, the market still largely believes that interest rates will be coming down in 2025, with Bloomberg forecasting 2.8% composite interest rates across all advanced economies by the end of 2025. The US is among the majority of countries expected to lower its rates this year. Lower interest rates would ease downward pressure on inflation which Powell said is a top priority to keep in check in the midst of tariffs. Lower rates, if accompanied by economic and policy certainty, would drive investment, borrowing, and expansion in the US- likely resulting in equity markets rallying. The Fed has a difficult job ahead in balancing these two effects.

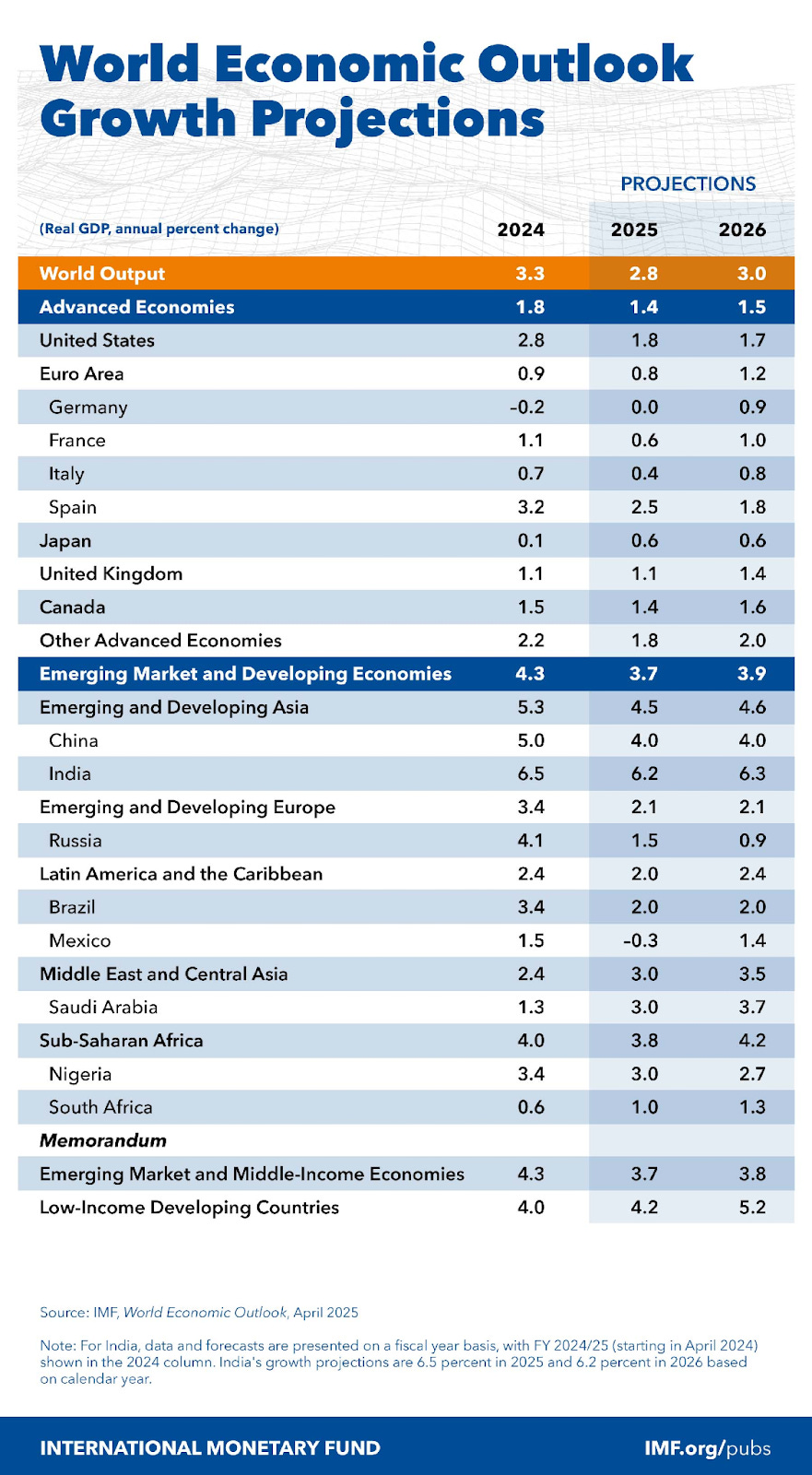

The International Monetary Fund revised its estimates for global growth this week, anticipating slower but still positive growth through 2025. China and India are ranked with the highest expected Real GDP Growth this year, meaning that exposure to companies in these regions could outperform if expectations hold true.

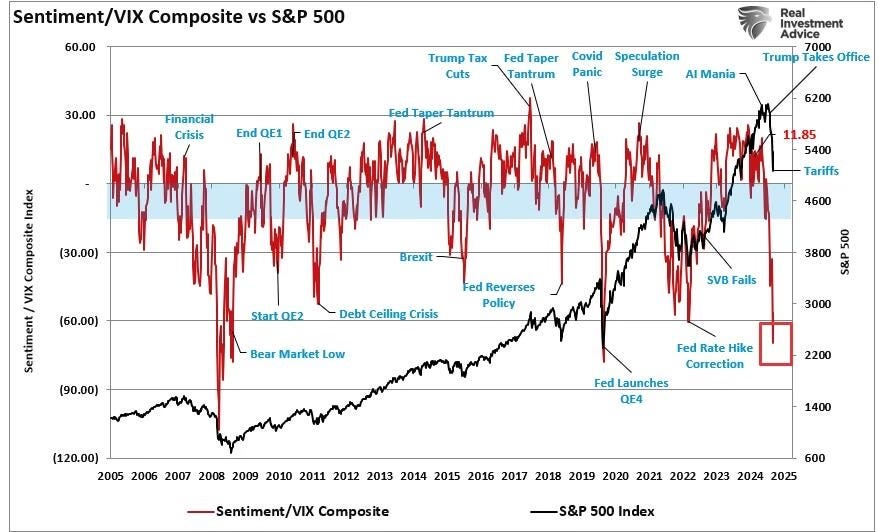

The US Policy Uncertainty Index experienced a spike on April 5th, which Goldman Sachs believes may indicate a buy signal in equity markets. This graphic shows 1 year returns of the S&P 500 Index after experiencing a spike in policy uncertainty, with 8 the last 10 occasions showing positive returns and an average return of 22%.

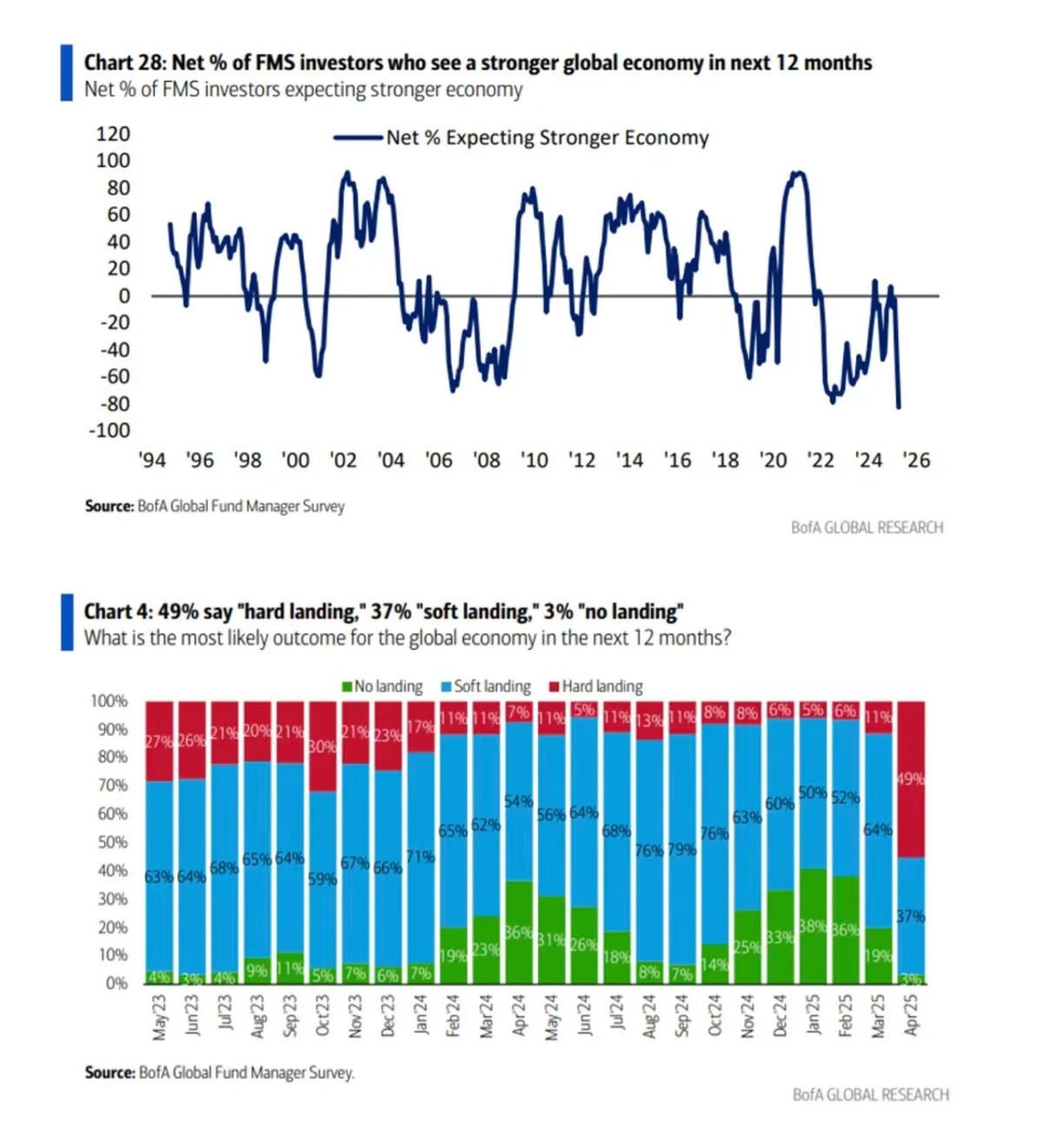

Market Outlook Charts

Consumer Discretionary

This week, the Consumer Discretionary sector remained under pressure as investors digested the early impact of recently enacted U.S. tariffs and signs of softening consumer sentiment. Retailers and e-commerce platforms, particularly those reliant on imported goods, began implementing price increases, while some reported declining traffic and reduced discretionary purchases. New data from the Conference Board showed a slight dip in consumer confidence, driven by inflation worries and uncertainty over future interest rates. Meanwhile, April earnings from key sector players like Amazon and McDonald’s showed mixed results, strong revenue but cautious guidance.

This week, BYD Company (BYDDY) made headlines by proposing a significant bonus share distribution plan, offering 8 bonus shares for every 10 held in 2024, as disclosed in a filing to the Shenzhen Stock Exchange. Amazon (AMZN) is facing pricing pressures as sellers are raising prices on hundreds of top-selling items due to increased import costs stemming from President Trump’s newly announced tariffs, which range from 104% to 125% on Chinese imports, prompting some to consider exiting the U.S. market. In Brazil, MercadoLibre’s (MELI) fintech arm, Mercado Pago, launched a new branding campaign with a fresh product and enlisted superstar Anitta as its new spokesperson, aiming to deepen its market penetration. Starbucks (SBUX) increased its quarterly dividend from $0.57 to $0.61, continuing a strong history of dividend growth, though it’s contending with internal tech issues after a ransomware attack affected scheduling systems.

Next week we are looking to add to SBUX and AMZN as things are evening out. We continue to hold on to the names we believe in.

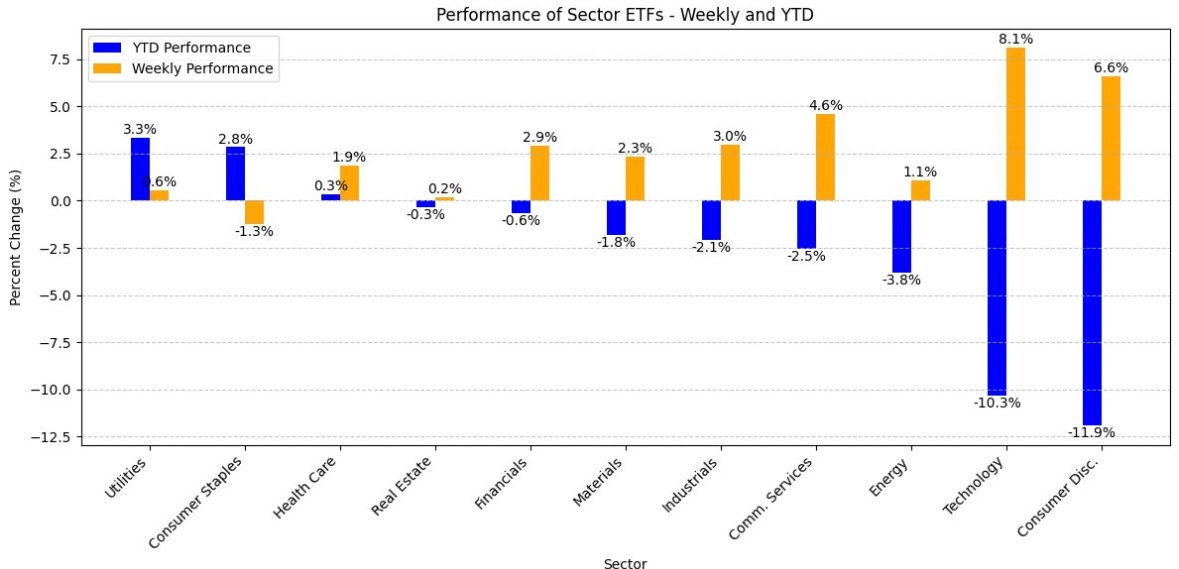

Although many sectors, particularly Technology and Consumer Discretionary, have faced significant year-to-date losses, there was a strong rebound across most sectors this past week. Sectors with the worst YTD performance saw the biggest weekly gains, suggesting a possible short-term recovery rally or shift in market sentiment. Technology and Consumer Discretionary sectors have finally reacted to speculation around potential tariff negotiations between China and the U.S., although no official agreements have been reached.

Benchmark: XLY: +8.01%

Biggest Winner (%) : BYDDY +12.60%

Biggest Loser (%) : MCD +1.85%

Consumer Staples

Philip Morris (PM) reported first-quarter 2025 earnings this week, with the stock gapping up 3% following a beat on both revenue and earnings per share. As expected, the company continues to command a higher valuation multiple, currently trading at a P/E of 22 and an EV/EBITDA of 16. While these levels are elevated compared to both peers and PM’s historical averages, we believe the company's strategic shift toward non-smoking products supports a sustainable premium. Notably, the non-smoking segment now accounts for approximately 42% of total revenue this quarter.

Walmart (WMT) has launched a new program in China aimed at supporting local Chinese companies by helping them sell products domestically. This move follows tensions earlier this year when Walmart requested Chinese suppliers absorb some of the costs from U.S. tariffs, leading to backlash from Chinese officials. By introducing this new initiative, Walmart appears to be repairing relations and reinforcing its commitment to the Chinese market.

PriceSmart (PSMT) reached a 52-week high at Friday’s close, driven by strong earnings and positive developments aligned with expansion plans anticipated by the staples research team.

Sherwin-Williams (SHW) is scheduled to report earnings this coming week. We are particularly interested in updates regarding their international operations, an area that has been a growing focus for the company.

Benchmark XLP (%): -1.26%

Biggest Winner (%): PSMT 6.77%

Biggest Loser (%): POST -1.94%

Energy, Materials, and Utilities

Despite ongoing concerns over global economic growth, particularly due to uneven recovery signals from China, the Energy Select Sector SPDR Fund (XLE) climbed 1.9%, driven by resilient energy demand and favorable U.S. production trends. Gold prices reached a new high of $3,499/oz, before retracing, propelled by safe-haven buying amid heightened geopolitical uncertainties and a softening U.S. dollar. Ongoing trade frictions, particularly U.S. tariffs on Chinese semiconductors and critical minerals, weighed on the Materials sector, while Utilities continued to attract defensive capital.

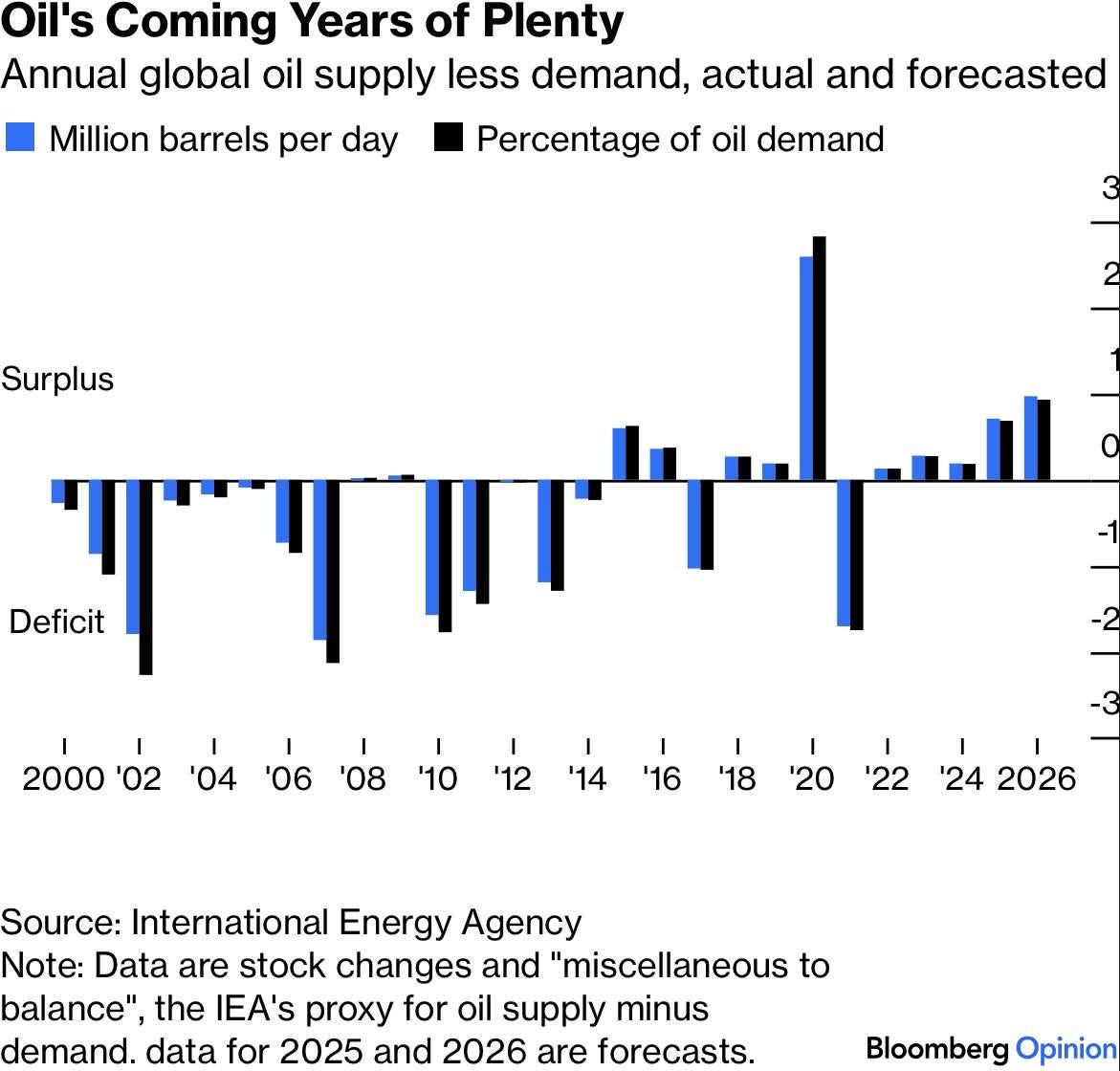

The energy sector outperformed broader markets, bolstered by steady crude oil prices and supportive U.S. policies, including streamlined drilling permits. Exxon Mobil Corporation (XOM) advanced 1.54%, closing at $108.57, underpinned by its low-cost Permian Basin output and robust Guyana projects. Antero Resources (AR) surged 2.6%, capitalizing on elevated natural gas prices tied to colder-than-expected spring forecasts. Energy Transfer (ET) gained 5.76%, supported by consistent pipeline throughput and its diversified midstream portfolio. Risks persist from potential OPEC+ supply increases and softer Asian demand, but our holdings’ domestic focus and operational efficiency provide a buffer.

Carpenter Technology (CRS) reported strong third-quarter fiscal 2025 results on April 24, 2025, with adjusted earnings per share of $1.88, surpassing the Zacks Consensus Estimate of $1.74. The company achieved net sales of $727 million, slightly below the expected $729.87 million but up 5.8% year-over-year, driven by robust demand in aerospace and defense, which accounts for 60% of its sales. The Specialty Alloys Operations segment posted an adjusted operating margin of 27.8%, reflecting productivity gains and optimized product mix. CRS raised its full-year operating income guidance to $500–520 million, signaling confidence in continued growth. The stock rose 3.5% for the week, closing at $183.12, supported by its strong domestic focus and minimal tariff exposure.

Escalating U.S.-China trade disputes, with China imposing retaliatory tariffs of up to 130% on select U.S. goods, continued to drive volatility in commodity markets. This dynamic benefits domestic producers like XOM, CRS, and Linde (LIN), which are less exposed to international trade disruptions. Gold’s rally, reflected in SPDR Gold Shares (GLD) and Gold Fields Limited (GFI), highlights investor unease over currency risks and trade wars. In Utilities, American Water Works (AWK) and Spire Inc. (SR) remain stable, offering defensive exposure amid market uncertainty.

While energy and gold markets show resilience, we remain vigilant for signs of weakening global demand, particularly from China’s industrial sector, which could impact AR, ET, and LIN. CRS’s strong earnings and guidance reinforce its resilience, but tariff-driven cost pressures may challenge margins in Materials. Our strategy continues to favor low-cost, domestically focused energy names, select materials producers like CRS, and defensive utilities to navigate near-term uncertainties.

Benchmark: XLE: +1.09%

Benchmark: XLB: +2.32%

Benchmark: XLU: +0.57%

Biggest Winner (%) : CRS +17.05%

Biggest Loser (%) : GFI -9.13%

Financials

Despite continued uncertainty revolving around President’s Trump’s tariffs and the ongoing trade war, the financials sector posted gains on the week, with our securities closely following. Leading the charge was Robinhood ($HOOD), which posted our biggest gains of the week of 20.08%. This bullish surge was led by investor optimism regarding HOOD’s upcoming Q1 2025 earnings report, which comes out on April 30th, and with a high beta, volatility in the market has helped boost up the stock price. Despite estimates of $0.33 per share being slightly lower than Q4 2024’s estimates of $0.42, they crushed their last earnings call and have nearly doubled expectations from Q1 2024 just a year ago. Along with a massive bullish engulfing candle, HOOD has positioned itself well to continue growing into 2025.

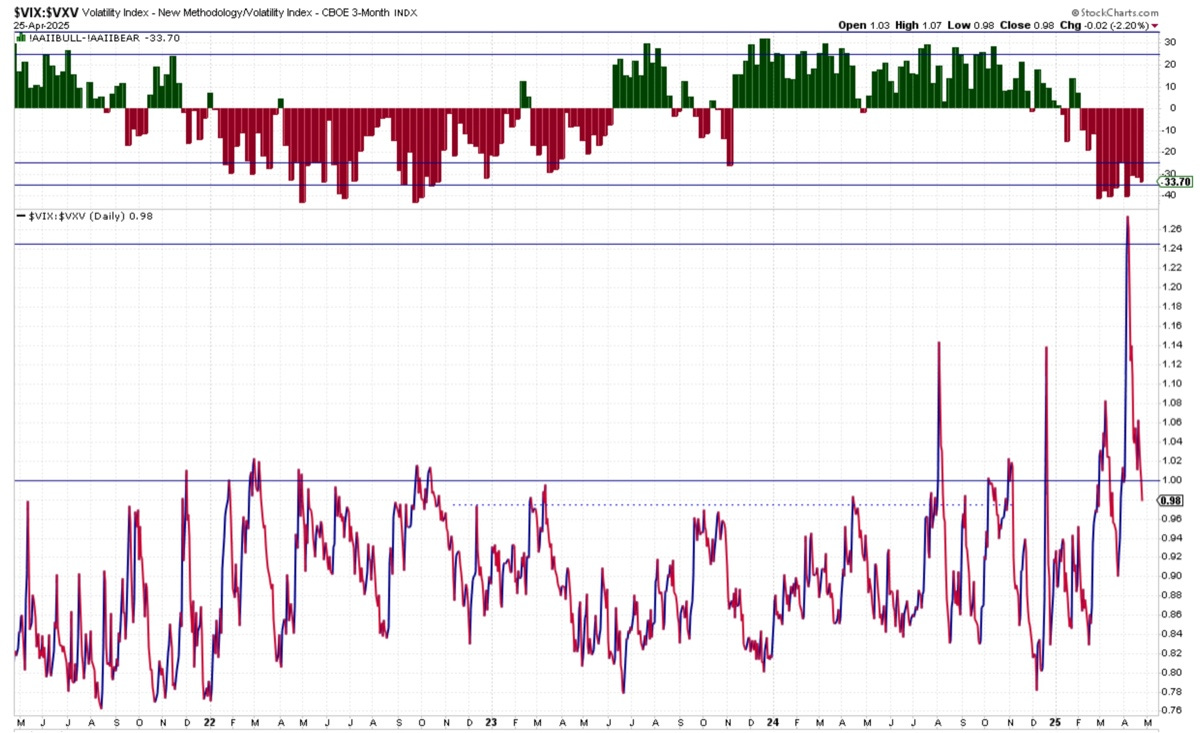

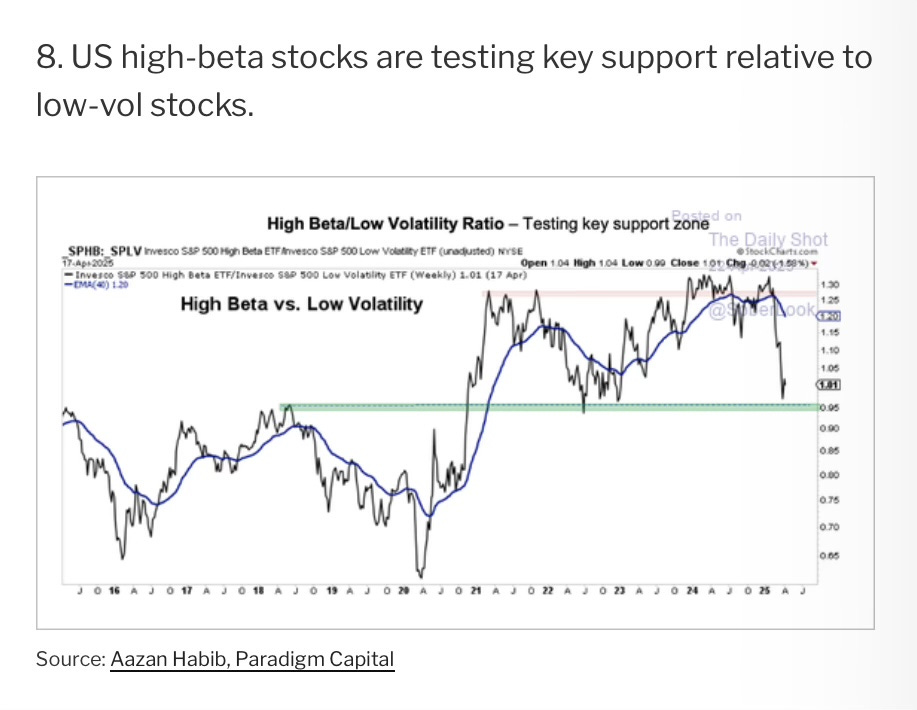

A key area where financials, along with the overall macro economy, has seen increasing volatility has been shown in spreads widening for US high-yield bonds. As shown in the figure below, wider spreads indicate lower financial strength for US corporations, so consumers are requiring a higher rate of return on these bonds. This is likely due to the uncertainty around the trade war with China, which has given us further reason to seek out international opportunities in the financials sector.

MSCI ($MSCI) reported their Q1 2025 earnings on April 22, posting $4.00 per share and beating estimates of $3.92 per share. They also bought back roughly $214 million more in treasury stock this quarter. Although the result was positive, it was largely inline with expectations, leading the stock to remain mostly flat to slightly lower. While forward guidance remains slightly higher, large financial institutions are confident in the company, which is reflected in recent recommendations. Goldman Sachs, Deutsche Bank, JP Morgan, and Morgan Stanley all have buy/ overweight ratings with price targets between $630-$675. We remain more bullish with an EV/EBITDA price target of $744.60 and are confident that higher future earnings while continuing their routine share buybacks will add more value in the future.

Bancolombia’s ($CIB) shareholders approved of their new holding company Grupo Cibest, indicating a big structural shift in the bank. This holding company is designed to consolidate the bank’s financial and non-financial operations across Colombia and Central America, per El Tiempo. The company also announced plans to repurchase $300 million in shares—approximately 3% of its free float—highlighting its continued strong financial position. Additionally, CIB’s $0.5745 per-share dividend, approved in March, will be distributed on April 29th to shareholders of record. This payout marks a 28% increase from last year and represents 69% of the period’s earnings, illustrating the company’s commitment to returning value to its investors.

Benchmark XLF (%): 2.78%

Biggest Winner (%): HOOD 20.08%

Biggest Loser (%): MSCI -2.15%

Healthcare

This week showed clear signs of strength across the healthcare sector. Merck & Co. (MRK) led the way with a strong double beat on both earnings and revenue, which helped boost the stock over 6% for the week. Their performance set a positive tone for the sector overall, where we saw broader strength driven by a high number of earnings beats from a variety of companies. Overall, earnings season has been supportive for healthcare, helping to lift sentiment across much of the industry.

However, not every name fared as well. Some companies struggled, including one of our largest holdings, UnitedHealth Group (UNH). UnitedHealth continued to decline in the wake of last week’s earnings miss and the release of weaker-than-expected guidance. Despite the near-term pressure on the stock, we remain confident in UNH’s long-term outlook. Their large and growing role in the Medicare space continues to make them a key player in the healthcare system, and we believe this strength will allow them to weather the current challenges over time.

In addition to earnings news, Eli Lilly (LLY) had another strong week as well. Positive reports were released regarding their new weight loss drug, which is in pill form. We believe this development could be a major catalyst for LLY moving forward. One of the major concerns with the current generation of GLP-1 treatments has been the need for injection, which is a hurdle for many patients. By offering a pill version, LLY could significantly expand access and adoption, putting them in a strong position to capture an even larger share of the rapidly growing weight loss drug market.

As new projections begin to incorporate LLY’s new pill-form GLP-1 treatment, we believe there is a major shift underway within their product lineup. Currently, LLY’s three leading GLP-1 drugs Mounjaro, Trulicity, and Zepbound dominate the market. However, we expect that the new oral GLP-1 will eventually overtake these existing treatments in both popularity and sales.

The chart above highlights just how strong LLY’s position already is, even without factoring in the impact of their upcoming oral option. With the addition of this more convenient pill form, we see significant upside potential that has not yet been fully priced into the market.

We believe the weight loss drug market overall is positioned to be a safe haven during this period of uncertainty across broader markets. The space continues to see rapid and consistent growth, driven by rising demand and broader acceptance of GLP-1 therapies. Given these trends, we are optimistic about LLY’s ability to capitalize on this opportunity and further strengthen their leadership in the sector.

Benchmark XLV (%): +1.89%

Biggest Winner (%): MRK +6.08%

Biggest Loser (%): UNH -7.81%

Industrials

The Industrials sector rallied despite opening the week lower. The SMIF Industrial sector increased by 3.2% compared to the 2.98% increase in the XLI. This comes right after we pointed out that the hard data was diverging from sentiment in last week’s weekly report, no big deal.

Last week's economic outlook suggested that the market may be oversold. As the hard data vs soft data was diverging, investors clearly saw this week as an opportunity to buy, as sentiment was low. As earnings season came underway, industrial stocks showed that the recent selloff may have been slightly overblown.

We had 3 companies report earnings this week, with Lockheed Martin (LMT) and 3M (MMM) reporting on Tuesday, and Old Dominion Freight Line (ODFL) reporting on Wednesday. LMT beat EPS and estimates by 15% and 1%, respectively. They maintained their guidance but didn’t include any tariff impacts in their projections, showing confidence despite all of the surrounding uncertainty. 3M also beat EPS and revenues, with CEO Bill Brown emphasizing their strong strategy to navigate the evolving tariff landscape. On Wednesday, ODFL beat estimates as well, however, revenues and shipping volumes saw year-over-year declines. A key storyline heading into their report was the potential threat of Amazon entering the LTL market. CFO Adam Satterfield addressed it head-on during the earnings call, framing Amazon’s presence as an opportunity to partner and support their growing logistics needs.

ODFL fell 8% on Friday due to rival Saia badly missing their Q1 earnings. EPS came in at $1.86, with estimates expecting $2.76, triggering a nearly 30% intraday plunge in its stock. The disappointing results raised broader concerns about the health of the LTL freight market, dragging down peers like ODFL in sympathy.

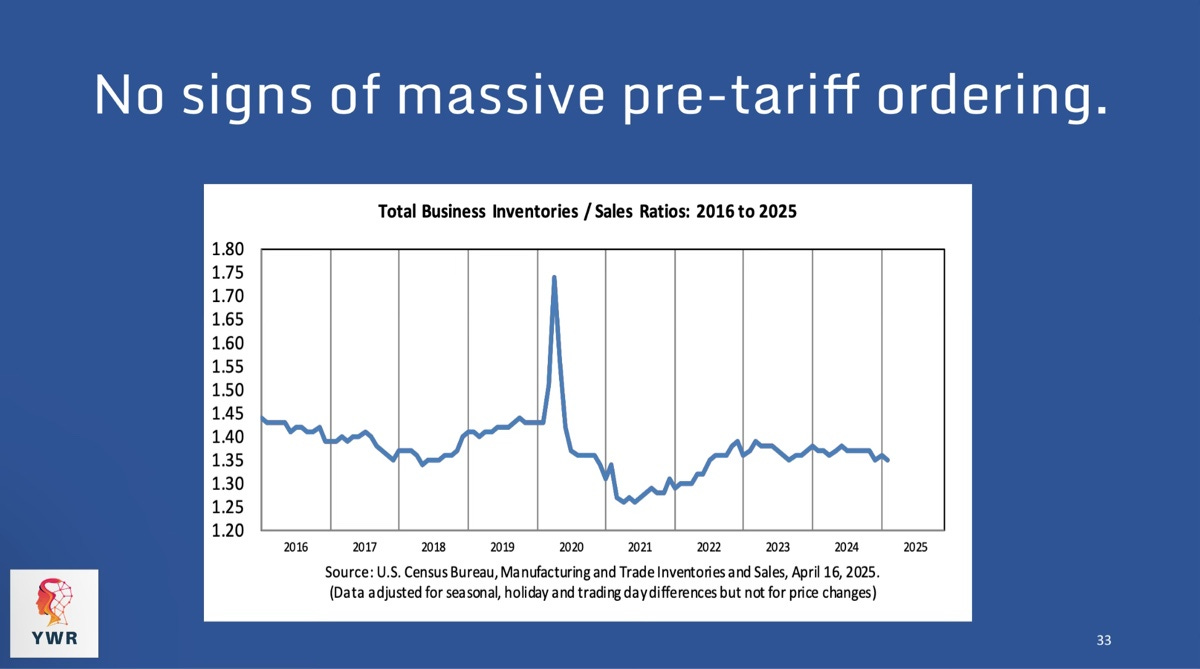

Despite people anticipating companies increasing inventory in anticipation of tariffs, the data shows that this hasn’t happened yet. This restraint could reflect uncertainty around how long tariffs will last or which products will be affected. For the industrial sector, this means short-term demand for transportation, warehousing, and manufacturing inputs may stay quiet. However, once tariff clarity emerges, a wave of ordering could cause a surge in freight volumes and equipment demand.

With stock pitch coming up and Q1 earnings to come, we will continue to monitor our holdings and use the hard data to determine our next moves. If sentiment continues to diverge from the hard data, we see it as an even greater opportunity to deploy our cash.

Benchmark XLI (%): +2.90%

Biggest Winner (%): SWK +7.64%

Biggest Loser (%): ODFL -4.56%

Technology

Major tech stocks saw a mix of strong earnings-driven gains and macro-induced pressures this week. Alphabet (GOOGL) delivered a solid first-quarter report, with advertising revenue up 8.5% year-over-year – a better-than-expected result that eased concerns about a digital ad slowdown. The Google parent’s bold bets on AI appeared to pay off as well, helping fuel core ad growth and prompting management to reaffirm heavy AI investment plans. Shares of Alphabet jumped roughly 3% on Friday after the beat, and the company announced a $70 billion share buyback – a signal of confidence that further buoyed investor sentiment.

Another standout was Amphenol (APH): the electronics connector maker surged 12% in its best one-day move in over a decade after reporting record first-quarter sales (up 48% YoY) and guiding above Wall Street’s forecasts for Q2. Amphenol credited robust demand from data centers, defense, and mobile devices – bolstered by the growing adoption of generative AI technologies – for its earnings beat and upbeat outlook.

Not all tech segments rallied, however. Semiconductor stocks faced headwinds as trade and competition worries persisted. On Friday, chip giant Intel (not in our holdings) issued a weak revenue and profit forecast, sending its shares down over 8% and casting a shadow over peers. The dour outlook – coming amid a U.S.-China tariff crossfire that is damping PC and server chip demand – underscored the challenges facing chipmakers. This sector-wide caution weighed on Advanced Micro Devices (AMD) and Taiwan Semiconductor (TSM), which remained under pressure following recent export curbs and tariff escalations.

Meanwhile, Chinese internet companies (tracked via KWEB) continued to grapple with volatility tied to geopolitics. Investors are closely watching the tariff standoff: President Trump hinted late in the week that negotiations with Beijing were underway, though Chinese officials denied this, highlighting still-murky prospects for relief.

Moving forward, Alphabet (GOOGL) and Microsoft (MSFT) are the two key names on our radar for potential portfolio additions. From a technical standpoint, Alphabet’s stock has just closed back above a key support level, reversing its recent pullback. This reclaim of support improves GOOGL’s technical setup – the shares are building positive momentum again after the strong earnings news. Microsoft, which reports earnings next week, is also trading in a constructive pattern. MSFT has been relatively resilient in the 2025 tech downturn and continues to hold its upward trend, hovering near its higher support levels and showing signs of an impending breakout.

Benchmark XLK: +8.09%

Benchmark XLC: +4.60%

Biggest Winner (%): APH +16.58%

Biggest Loser (%): ADBE +5.24%

Risks & Opportunities

Risks:

While this week’s market rebound was fueled by optimism over Trump’s softer tone on tariffs and support for Fed Chair Powell, several risks still remain. First, no formal trade agreements have been signed yet. Tariffs are still in place, and negotiations with China remain fragile. Any breakdown in talks could quickly erase gains. There’s also the risk of complacency, investors may be too quick to assume a smooth path forward. Policy uncertainty remains high, and the recent rise in the U.S. Policy Uncertainty Index shows that markets are still on edge. Lastly, while lower interest rates are expected in 2025, any shift in inflation or unexpected Fed actions could derail the recovery narrative. Until more concrete progress is made, markets are likely to stay volatile.

Opportunities:

Despite the risks, the tone of the market has clearly improved. Trump’s commitment to avoid firing Powell and his remarks about easing tariffs open the door for more stable monetary policy and trade relations. History shows that spikes in policy uncertainty often lead to strong market returns once clarity improves — and we could be entering that phase now. With global growth still positive and central banks signaling a more dovish stance, there’s real potential for a sustained rebound if trade negotiations move forward. Exposure to companies tied to global growth, especially in emerging markets like India and China, could outperform if the recovery strengthens.

Conclusion

Our portfolio rose 2.42% this week, trailing the S&P 500’s strong rally but showing positive momentum as sentiment improved. As we move through earnings season and keep an eye on trade developments, staying diversified and cautiously optimistic will be key. We continue to look for opportunities in underpriced sectors and regions showing relative strength, while being mindful of volatility tied to policy shifts. With expectations for rate cuts later this year, patience and strategic positioning will be critical as we navigate the path forward through Q2.

More to come!

- SMIF

Disclaimer: None of the views or opinions expressed here is indicative of those held by West Virginia University. The content provided by the WVU Student Managed Investment Fund newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.