Undervalued in a Bull Market: Why Pan American Silver (PAAS) Could Outshine in the Silver Rally

Energy, Materials, and Utilities Sector Deep Dive: WVU SMIF Investment Thesis

Thesis Overview

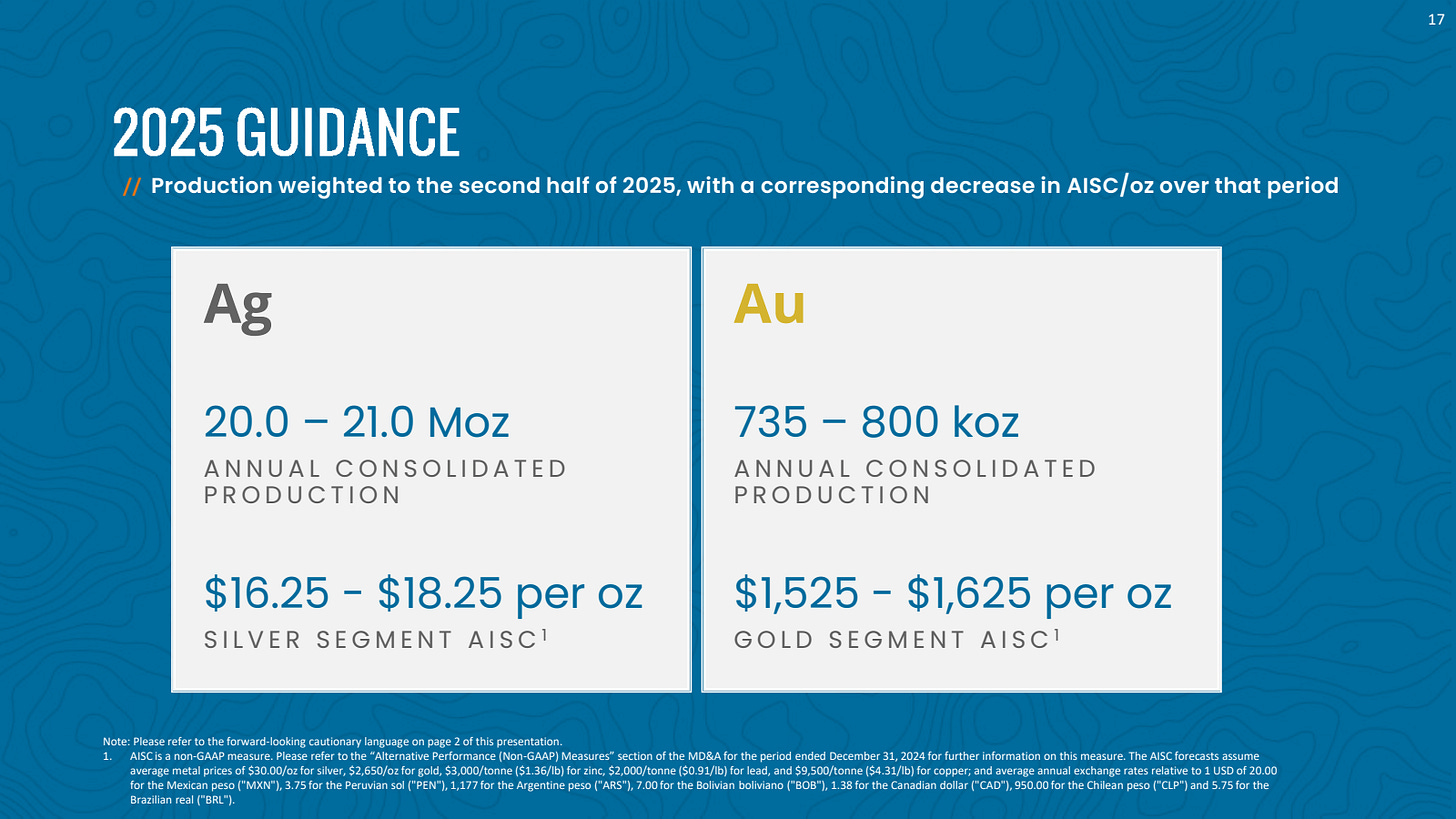

Long Pan American Silver Corp. (PAAS) – The EMU team has taken a long position in PAAS, the leading producer of silver and gold in the Americas, with 12 projects currently operating and 2 developing projects from Eastern Canada to Argentina. In 2024, PAAS produced [1] 21.1 Moz of silver and 892.5k oz of gold, and is on pace to match its 2025 production guidance of about 21 Moz of silver and 800k oz of gold. With an excellent production track record, a good technical pattern, and a precious metals bull market materializing, we see PAAS based on a P/E valuation vs itself and peers as undervalued. Our 6-month price target for PAAS is $53.33.

Entry Price: We purchased 220 shares for $38.08 on September 26, 2025 after a decisive close above the $36.50 price level.

Position Size: When considering how much to allocate to PAAS, we considered the current momentum of the precious metals markets, contrasting with the cyclical nature of the mining industry. We also considered our existing positions in highly correlated gold miner, Gold Fields Ltd, and our substantial position in the SPDR Gold Trust. Our analysis resulted in an allocation of 1% of the SMIF portfolio for a balanced mix of potential upside with minimal portfolio level downside risk.

Stop-Loss: $32.00.

Business Overview

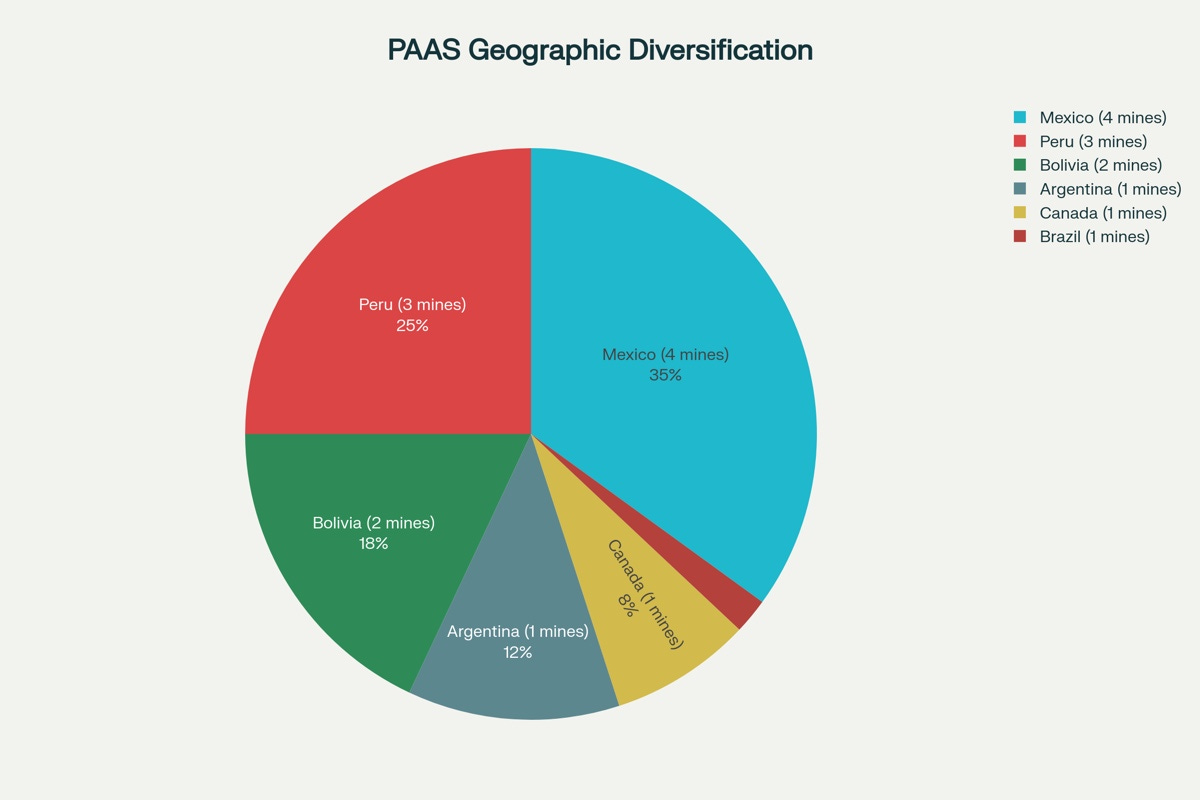

Pan American Silver Corp. is headquartered in Vancouver, Canada. It was established in 1994 to assume control of Pan American Minerals Corp. After purchasing their first mine in Peru, Quiruvilca, the company was listed on the stock exchange and continued purchasing mines in Mexico, Peru, Argentina, Bolivia, Brazil, and Chile. PAAS runs two main business segments: refined silver and gold, as well as zinc, lead, copper, and silver concentrates. The corporation focuses on efficiency. This is particularly true of its acquisition strategy. PAAS focuses on making acquisitions of companies where it an easily improve operations, production, and profitability. This strategy has resulted in acquisitions of various assets and businesses across the North and South American continents.

Their efforts were most recently on display with their $500 million USD acquisition of MAG Silver [2], that close on September 4, 2025. This acquisition gave PAAS a 44% interest in the Juanicipio mine operated by Fresnillo in Mexico. The Juanicipio mine [3] is expected to produce between 14.7 Moz and 16.7 Moz of silver in 2025, translating to roughly 6.5–7.3 Moz attributable to PAAS. These new gains boosted their silver production by about 35%, increasing total potential output to approximately 26.5 Moz – 28.3 Moz in 2025. Recently, Pan American Silver has reaffirmed its 2025 silver production guidance at 20–21 Moz.

Silver prices surged to a 14-year high of around $47/oz in September 2025. This allows PAAS to utilize both existing reserves and newly mined silver at premium prices, ultimately increasing free cash flow generation for the business. PAAS is also looking to become a sustainability leader [4] within the industry, investing over $20 million USD in surrounding communities [5] through efforts such as avocado tree planting, biodiversity protection, and guinea pig breeding.

Fundamental Rationale

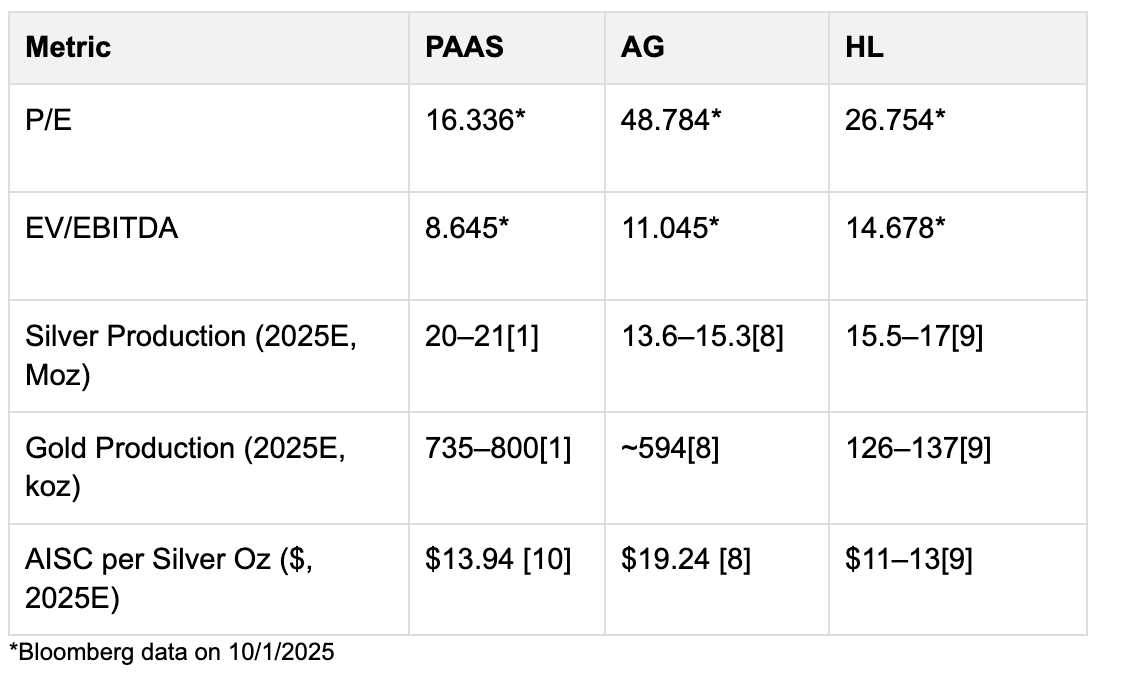

PAAS’s fundamentals have shown consistent growth since 2020, with operating cash flow seeing an 11.9% CAGR, consistent dividend increases (20% increase in Q2 2025 ), 20.5% CAGR for total revenue (32.0% in the gold segment), and EBITDA experiencing a 24.2% CAGR. The company boasted record levels of free cash flow of $233.0 million USD and mine operations earnings of $336.2 million USD (33.66% margin). They also currently sit on nearly double the reserves (as of 06/30/25) of Hecla Mining [6] (HL) at 452.3 Moz compared to HL 239 Moz. PAAS [7] consistently adds to its silver reserves, which may bode well for the miner in the coming months if silver continues to rise past $47/oz.

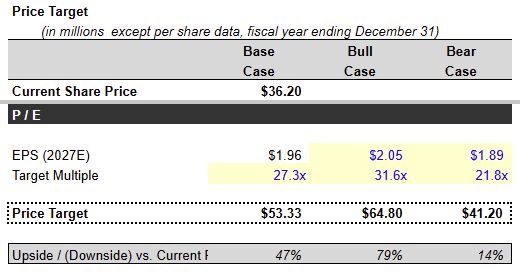

This valuation snapshot for PAAS uses a P/E multiple approach and suggests significant upside from current levels. With a base case price target of $53.33 and a bull case as high as $64.80, this represents 47% to 79% potential upside. Market sentiment and earnings momentum could push shares substantially higher if silver’s rally continues. Even in the bear case, there’s still a projected 14% upside, demonstrating a strong risk vs reward profile for PAAS at today’s prices.

Technical Setup

Silver just logged its highest quarterly close ever, making headlines and drawing bullish commentary from macro strategists like Tavi Costa. With the metal breaking through long-term resistance, this technical breakout is providing support for top producers like Pan American Silver. Historically, moves like this have sparked multi-quarter rallies as momentum builds and new investors pile in, setting the stage for PAAS to benefit from greater earnings power and strong stock performance as the bull market in silver continues.

When analyzing PAAS’s technical picture, we see a 17-year level of resistance in the $36.50 area that has been tested three times in the past. This important resistance level is now being tested for a fourth time. This pattern is clearly visible on a weekly, monthly, and quarterly chart. Historically, when a long-term chart pattern aligns with a strong horizontal resistance, it increases the likelihood of a breakout, which gives PAAS strong potential as a winner. The PAAS weekly chart has closed over $36.50 to confirm this breakout. In response to this bullish development, we have decided to take a long position in the stock. This current test of the $36.50 area is accompanied by improved company fundamentals, driving by substantially higher silver prices. Therefore, the probability of this breakout holding above the $36.50 level are greater than in the past.

Sentiment Analysis

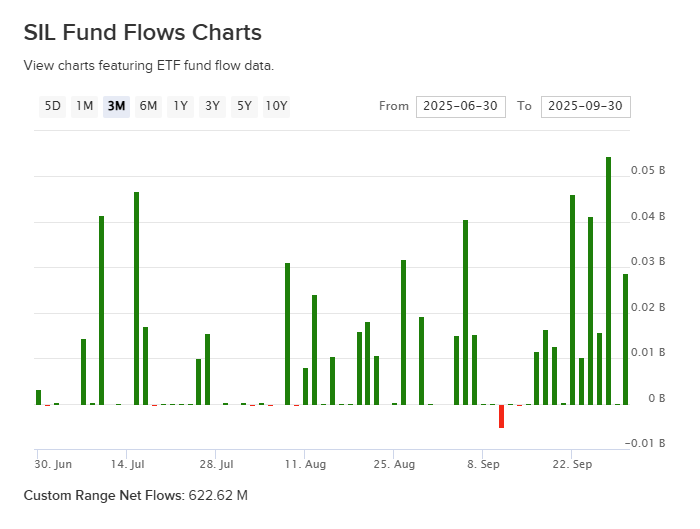

As some equity sectors reach historic valuations, retail and institutional investors have been deploying capital into precious metals and mining equities. The strong positive sentiment on the silver market and miners is reflected by the growth in the global silver miners index (SIL) [10], up 103.48% in the last 12 months as of October 1, 2025. PAAS is currently 13% of the SIL ETF, and inflows[11] are continuing to increase into SIL, which will drive even more demand to silver miners, further driving up the price of PAAS. Wall Street analysts appear to lean bullish as well, with 6 analysts assigning a “Buy” rating, and only 3 rating PAAS a “Hold” [12].

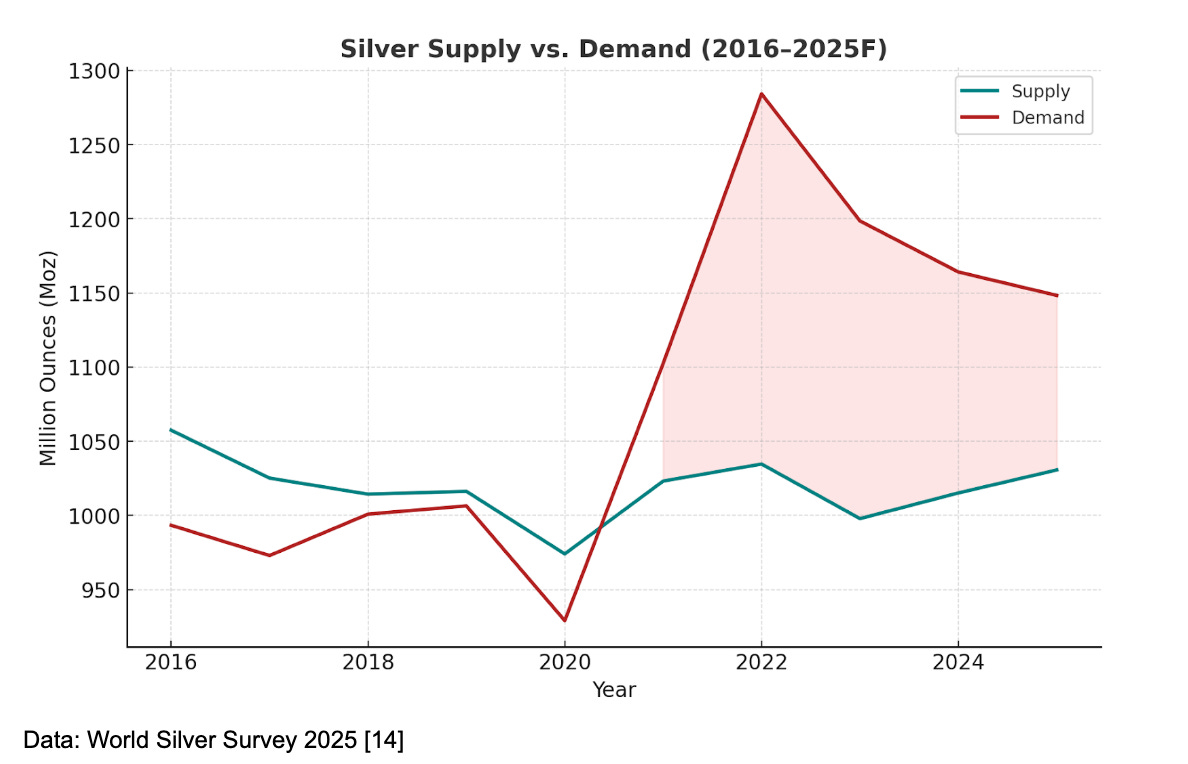

A driving factor behind the influx of capital to silver miners is that, within the last 4 out of 5 years, we have seen a supply deficit of silver and rising demand for industrial use. If silver prices continue to climb, miners will be able to deploy their current reserves and recently mined silver at a premium, leading to an increase in revenues. In PAAS’s case, they have been able to lower their AISC (all-in sustaining costs per silver ounce) [13] by 16% since last year, helping increase their gross margins. Overall, the increased investment in silver is being fueled by its increased demand in industrial use, against the shortage of supply, as well as a precious metal to store value as fiat currencies continue to depreciate in real terms.

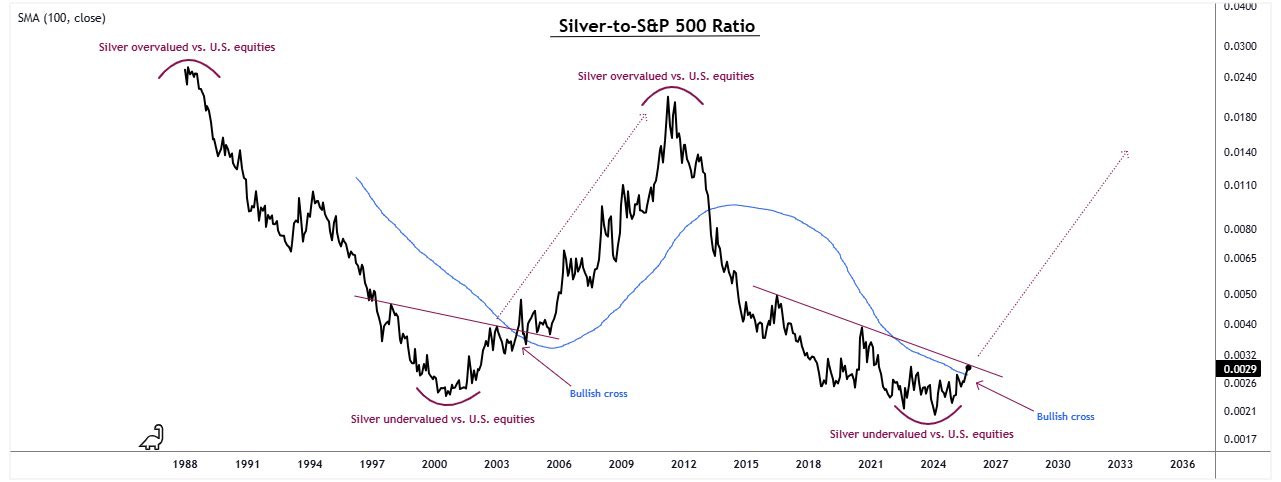

The chart above shows the silver-to-S&P 500 ratio, which has just triggered a bullish crossover after years of silver being undervalued relative to U.S. equities. Historically, this kind of breakout has been a signal for a major shift in sentiment, sparking powerful, multiple year rallies as investors rotate back toward silver assets. For PAAS, this should boost the stock as market optimism builds and silver regains favor versus equities.

Key Assumptions & Catalysts

Our thesis rests on the idea that positive sentiment and the structural deficit of silver [15] will not only push the price of the metal into seldom seen price levels, but those prices will, in turn, drive up revenue figures for silver miners as an industry. The bull market that appears to be forming for all commodities will impact the other mining segments for PAAS as well, hopefully propelling all figures to new heights. We are also using the assumption that under the current administration, there will not be any major regulatory or economic policy changes that will drastically affect operating costs or negatively impact any segments materially. Besides the price appreciation of silver, the other event we see as a catalyst for growth in the miner is the successful integration of MAG Silver after the acquisition closed on September 4, 2025.

Exit Strategy & Risk Management

We allocated 1% of our portfolio in PAAS to limit losses if our thesis does not play out as planned. Our recommended stop loss is at $32, which is a long-term technical support line. Our bull thesis also relies on the silver market continuing to rally, but if we see a pullback in the silver price to $37/oz, we will have to re-evaluate our position in PAAS.

As for company-specific indicators on this position, we are confident that management will continue to hit their production guidance and capitalize on new projects, ensuring that they add value to the bottom line. If management weakens guidance and/or overpromises and underperforms, PAAS would need to be re-evaluated.

For our exit strategy, we see PAAS beating earnings in H2 with silver prices rising. Historically, miners can be volatile, but we see this position as one we hope to hold through the new year and would ultimately exit once we believe the silver market is topping out. We will keep a close eye on fundamental data and technical indicators to put us in the best position to manage this position.

Key Risks to Thesis

Metal Price Volatility: PAAS earnings and cash flow [16] directly correlate with silver and gold prices. Any prolonged downturn could weigh substantially on results and valuation. If the commodities cycle turns negative for multiple annual periods, PAAS could be forced to cut back on expansion and development, impacting long-term growth.

Regulatory and Political Risk: Based on the geographic regions of the world PAAS operates [17], changes in laws, taxes, or environmental regulations, or forms of political instability could raise costs, delay projects, or threaten asset security.

Production Challenges: Production delays, ore grade declines at key mines like Cerro Moro and San Vicente [18], and mining accidents, could potentially disrupt output and raise production costs.

Inflationary & Cost Pressures: Rising energy, labor, and equipment costs could potentially squeeze their overall margins. Supply chain [3] disruptions and tariff increases could also have negative impacts on total revenue.

Declining Revenue Growth: Consensus analyst forecasts [19] point to the potential for declining annual revenue growth over the next few years despite recent financial strength. These results could hurt the share price and sentiment.

Economic Stability: Both silver and gold have served as a hedge against economic uncertainty and inflation spikes. If inflation and interest rates stabilize, it may reduce the safe-haven [20] appeal of precious metals like silver and gold. If this were to occur, it could lead to weaker metal prices, directly impacting PAAS’s overall revenue and earnings.

Decision-Making

Pan American Silver Corp. offers a high-quality, long-term opportunity with direct exposure to the precious metals bull market. Consistent dividend growth, as well as a recent acquisition, prove that PAAS’s leaders expect the industry and the company to continue to thrive. With 3-year low costs per oz of silver [13], 79% upside opportunity, and limited downside risk, the bull thesis is compelling. The trifecta of fundamentals, technical analysis, and market sentiment highlight our conviction that PAAS is poised for long-term success.

Sources

[1] Pan American Silver Q4 2024 Earnings Review | https://panamericansilver.com/wp-content/uploads/2025/01/Q4-2024-Conference-Call-Slides_vF.pdf

[2] Pan American Silver Completes Acquisition of MAG Silver |

https://panamericansilver.com/news/pan-american-silver-completes-acquisition-of-mag-silver/

[3] Pan American Silver 2nd Quarter Report to Shareholders June 30, 2025 | https://panamericansilver.com/wp-content/uploads/2025/01/PAAS-06-30-2025-Website-Report-08.06.25-2.25pm.pdf

[4] Goals & Performance Pan American Silver | https://panamericansilver.com/sustainability/our-approach-and-performance/goals-performance/

[5] Sustainability Pan American Silver |

https://panamericansilver.com/sustainability/

[6] Hecla Mining Company - Reserves and Resources – 12/31/2024 | https://www.hecla.com/wp-content/uploads/RR-tables-12-31-2024.pdf

[7] Pan American Silver Corp. Mineral Reserves | https://panamericansilver.com/operations/reserves-and-resources/

[8] PAAS Vs AG: Which Silver Mining Stock Shines Brighter in 2025?|

https://www.nasdaq.com/articles/paas-vs-ag-which-silver-mining-stock-shines-brighter-2025

[9] PAAS vs. HL: Which Silver Mining Stock is the Better Buy Now?|

https://www.nasdaq.com/articles/paas-vs-hl-which-silver-mining-stock-better-buy-now

[10] Silver Miners ETF (SIL) |

https://www.globalxetfs.com/funds/sil

[11] Silver ETFs: Shining Through the Market Noise | https://www.etftrends.com/silver-etfs-shining-market-noise/

[12] PAAS Stock Forecast |

https://tickernerd.com/stock/paas-forecast/

[13] Silver AISC at Multi-Year Low for PAAS: Can It Sustain These Levels | https://www.tradingview.com/news/zacks:0b59f841b094b:0-silver-aisc-at-multi-year-low-for-paas-can-it-sustain-these-levels/

[14] World Silver Survey 2025 | https://silverinstitute.org/wp-content/uploads/2025/04/World_Silver_Survey-2025.pdf

[15] Silver’s Structural Deficit Intensifies as Industrial Demand Outpaces Supply | https://www.cruxinvestor.com/posts/silvers-structural-deficit-intensifies-as-industrial-demand-outpaces-supply

[16] Breaking Down Pan American Silver Corp. (PAAS) Financial Health: Key insights for Investors | https://dcfmodeling.com/blogs/health/paas-financial-health

[17] Conflict and harm at Pan American Silver | https://theecologist.org/2020/mar/04/conflict-and-harm-pan-american-silver

[18] Pan American Silver: Per Share Metrics Slip Post Acquisition | https://seekingalpha.com/article/4820412-pan-american-silver-per-share-metrics-slip-post-acquisition

[19] Optimistic Investors Push Pan American Silver Corp. (TSE:PAAS) Shares Up 26% But Growth Is Lacking | https://simplywall.st/stocks/ca/materials/tsx-paas/pan-american-silver-shares/news/optimistic-investors-push-pan-american-silver-corp-tsepaas-s-1

[20] We Think That There Are Issues Underlying Pan American Silver’s (TSE:PAAS) Earnings | https://finance.yahoo.com/news/think-issues-underlying-pan-american-125401655.html?guccounter=1

Disclaimer: None of the views or opinions expressed here is indicative of those held by West Virginia University. The content provided by the WVU Student Managed Investment Fund newsletter is for general information purposes only. No information, materials, services, or other content provided in this post constitutes solicitation, recommendation, endorsement, or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.